Flat Tax – 2026 Changes

If you’re self-employed and earn up to 2 million CZK per year, you can use the extended flat-rate tax.

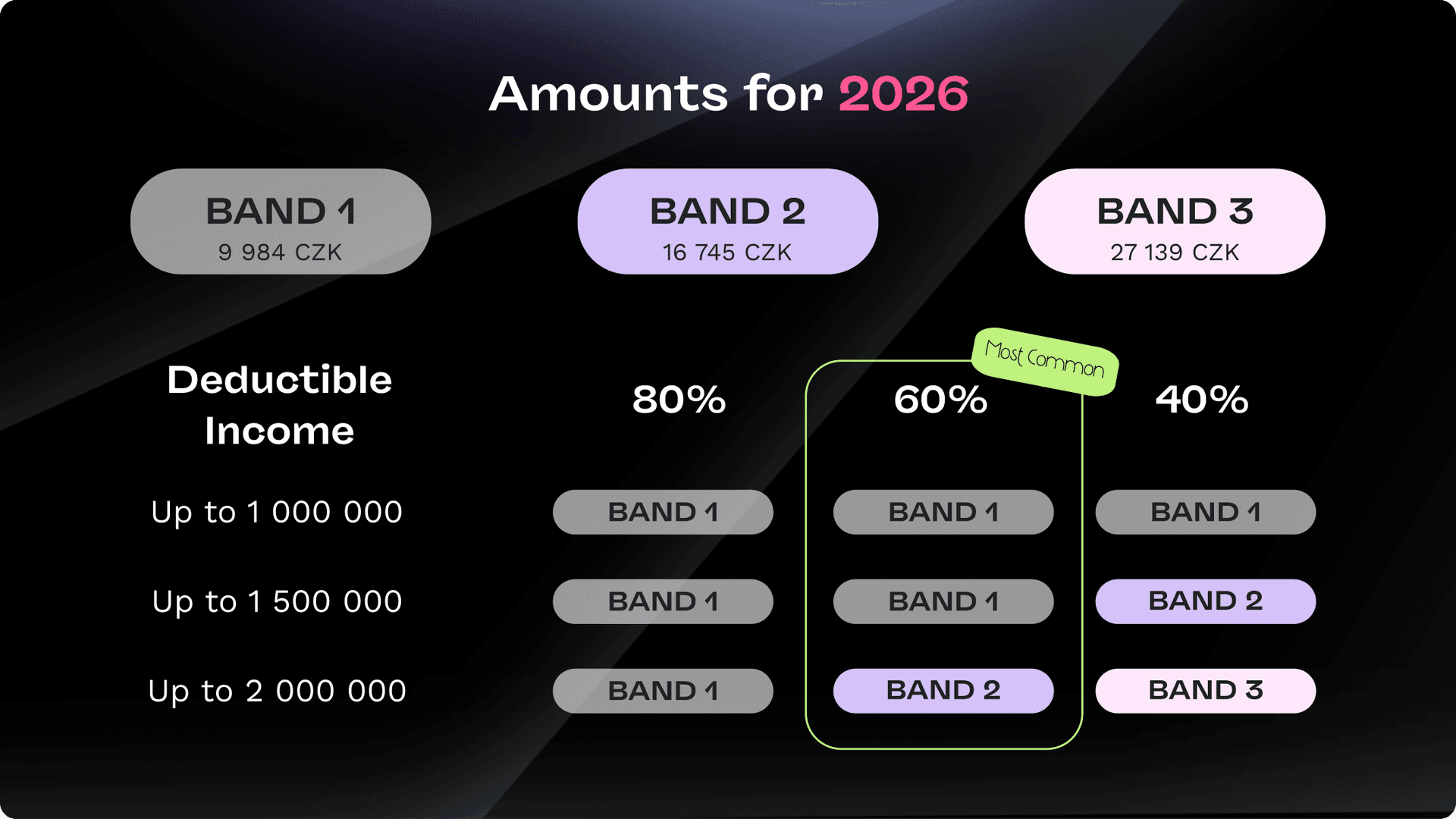

For 2026, there are new lump-sum income and expense limits.

Please note: The flat tax in the Czech Republic changed in 2026.

The main update is:

• Band 1 monthly payment has increased, while Bands 2 and 3 remain the same.

Flat tax combines income tax, social insurance, and health insurance into one fixed monthly payment.

Flat Tax (Paušální Daň) Registration Deadline

The flat tax in the Czech Republic can be registered, changed, or canceled only until 11 January.

By 11 January, you can:

Register for the flat tax,

Change your flat tax band,

Cancel the flat tax and return to regular taxation.

After 11 January, no changes are allowed. If the deadline is missed, the selected tax regime applies for the entire year.

Tax Rates vs Tax Bands vs Tax Brackets

A tax rate band is the amount of income which will be taxed at a particular percentage (tax rate). The current tax rates are 40%, 60%, and 80%

Example: the 60-40 tax reporting method is the most common. Using this method, the taxpayer deducts 60% of annual income, and pays tax on the remaining 40%

Each tax bracket is a range of income with a different tax rate.

In the Czech Republic, flat tax brackets are divided into earners up to 1 000 000 CZK, up to 1 500 000 CZK, or up to 2 000 000.

The flat tax rate bands are further divided by the taxpayer’s reported deductible expenses: either at 40%, 60%, or 80%.

Tax Rates: 40%, 60%, and 80%

The amount of flat-rate expenses depends on the type of trade business. In other words, we calculate expenses as a percentage of revenue, depending on the area of business. We subtract:

80% of income from agricultural production, forestry and water management and income from craft trades; however, you can claim expenses up to the amount of 1 600 000 CZK

60% of income from trade business; however, you can claim up to 1 200 000 CZK

40% of other income from independent activities (with the exception of income according to paragraph 1 letter. (d) and paragraph 6), however, you can claim up to CZK 800 000

30% of rental income from commercial property; however, expenses up to CZK 600 000 can be claimed at most.

Flat Tax Rate Band 1

For annual income up to CZK 1 million, no matter where the income derives from; or

Annual income up to CZK 1,5 million if at least 75% of income is from self-employment that can be reported using the 80-20 or 60-40 method; or

Annual income up to CZK 2 million if at least 75% of income is from self-employment in which a tax rate of 80% can be applied

Monthly payment for flat tax rate band 1: CZK 9,984 (covering monthly installments for income tax at CZK 100; social insurance at CZK 6,578; and health insurance at CZK 3,306 )

Flat Tax Rate Band 2

For annual income up to CZK 1,5 million, no matter of the activity which the income derives from; or:

Annual income up to CZK 2 million if at least 75% of income is from self-employment that can be reported using the 80-20 or 60-40 method

Monthly payment for flat tax rate band 2: CZK 16,745 (covering monthly installments for income tax at CZK 4,963; social insurance at CZK 8,191; and health insurance at CZK 3,591)

Flat Tax Rate Band 3

For annual income up to CZK 2 million, no matter of the activity which the income derives from

Monthly payment for flat tax rate band 3: CZK 27,139 (covering monthly installments for income tax at CZK 9,320; social insurance at CZK 12,527; and health insurance at CZK 5,292)

Flat Tax 2026: Monthly Payment Breakdown by Band

Breakdown | Band 1 | Band 2 | Band 3 |

|---|---|---|---|

Income Tax | 100 CZK | 4 963 CZK | 9 320 CZK |

Social Insurance | 6 578 CZK | 8 191 CZK | 12 527 CZK |

Health Insurance | 3 306 CZK | 3 591 CZK | 5 292 CZK |

Total Monthly Payment | 9 984 CZK | 16 745 CZK | 27 139 CZK |

All information verified using data from the Czech Financial Administration (Finanční správa ČR), maintained by Pexpats.

The table below shows how much you’ll pay in total per year under each 2026 flat tax band.

Total Flat Tax Payment for the Whole Year 2026

Band | Annual Flat Tax |

|---|---|

Band 1 | 118 608 CZK |

Band 2 | 200 940 CZK |

Band 3 | 325 668 CZK |

All information verified using data from the Czech Financial Administration (Finanční správa ČR), maintained by Pexpats.

Czech Flat tax for foreigners

There is a possibility to register a trade license and apply for flat tax at the same time. This works only for foreigners who have permanent residence or an already generated Rodné číslo — in practice, foreigners who already live in the Czech Republic.

If you have never been employed in Czechia and never had a trade license before, the flat tax application is usually rejected.

With flat tax, all payments are handled through the tax office. You pay one flat tax amount to the tax office, and the tax office then splits the payment between income tax, social security, and health insurance. This is done by Finanční správa České republiky.

If you are a foreigner and do not have a Rodné číslo or permanent residence, each authority must first create its own registration number for you. Because these numbers do not exist yet, the flat tax cannot be registered correctly.

When you apply for a flat tax without these registration numbers, the application may be pending for some time, but it is rejected in the end, because the tax office has no number under which it can take over your registrations and payments.

If you have never lived in the Czech Republic, you do not have a Czech personal number. That is why in the first year, you should use the standard 60/40 expense method and first get your tax, social security, and health insurance numbers.

From the next year, you can switch from 60/40 to a flat tax.

Switching Between Regular and Flat Tax

You have the option to choose between regular tax and flat tax once a year. This means you can switch from the regular tax method to the flat tax method, or vice versa. However, there are specific rules for when you can make this change:

Changes can only be made once a year.

You can make these changes from January 1st to January 11th.

You must wait until the end of the tax year to make any changes.

You Don’t Qualify for the Czech Flat Tax (Paušální Daň)

You don’t qualify for the flat tax (paušální daň) in the Czech Republic if:

Your income in the previous year was higher than the limit for your flat tax band.

You are registered as a Czech national VAT (DPH) payer. Light VAT (identified person) does not cancel flat tax.

You are a shareholder of a veřejná obchodní společnost (v.o.s.) or a komanditní společnost (k.s.).

You have unpaid debts with the Czech government authorities.

You are employed full-time by a Czech company.

You have non-business income from capital gains, rental income, or other income above CZK 50,000 in total.

When Is the Czech Flat Tax (Paušální Daň) Canceled?

Flat tax (paušální daň) in the Czech Republic is canceled if:

Your income goes over the limit for your flat tax band.

You register as a Czech national VAT payer. Light VAT (identified person) does not cancel the flat tax.

You become a shareholder of a veřejná obchodní společnost (v.o.s.) or a komanditní společnost (k.s.).

You declare bankruptcy and the insolvency is not completed within the year.

Your trade license is terminated or canceled.

You take full-time employment in the Czech Republic and your trade license becomes secondary income.

You end your business activity in the Czech Republic and move your tax residency abroad.

You voluntarily cancel your flat tax during the registration or deregistration period.

Advantages and Disadvantages of Flat Tax Reporting

Keep in mind that the flat tax reporting method isn’t always beneficial for the taxpayer. In fact, the flat tax system usually works better for solo entrepreneurs, as they often have fewer deductions and bonuses to claim, such as those for an unemployed spouse or for having children.

Advantages:

The main advantage of the flat tax is that there is no need for income tax paperwork.

You’ll pay much less tax than under the 60/40 rule if you are single and your income exceeds 1.5 million CZK.

Disadvantages:

Since no tax declarations or paperwork are required, you won’t have any official documentation to prove tax payments. This can make it difficult for foreigners under the flat tax system to prove Czech tax residency to their home countries.

Without tax return forms, there’s no proof of paying or declaring taxes in the Czech Republic.

You won’t have access to additional relief, discounts, or bonuses.

Registering for the flat tax can complicate mortgage applications.

It may make it impossible to get a Czech visa extension, permanent residency, or Czech citizenship.

Therefore, it’s always a good idea to consult with a professional tax advisor before registering for the flat tax.

How to Pay the Flat Tax (Paušální Daň) in the Czech Republic

Flat tax (paušální daň) payments are made once a month, usually by the 20th day of each month.

Each payment combines income tax, social insurance, and health insurance into one fixed monthly amount according to your tax band.

When making the payment, use the following details:

Payment prefix (předčíslí): 2866

Variable symbol: your DIČ (tax ID) number

Account number: account of your local Financial Office

Bank code: 0710 (Czech National Bank)

Payment frequency: monthly — usually paid by the 20th of each month

Flat tax payments are sent directly to the Czech Financial Office and include all three obligations in one transfer.

Using your DIČ as the variable symbol ensures that your payment is correctly matched to your taxpayer record. If you have any doubts, feel free to reach out to Pexpats for professional help with taxes in the Czech Republic.

Flat Tax Payment Bank Accounts in the Czech Republic (2026)

Czech Tax Office | Account Number(with Prefix) | Bank Code |

|---|---|---|

Prague | 2866-77628031 | 0710 |

Central Bohemia | 2866-77628111 | 0710 |

South Bohemia | 2866-77627231 | 0710 |

Plzeň | 2866-77627311 | 0710 |

Karlovy Vary | 2866-77629341 | 0710 |

Ústí nad Labem | 2866-77621411 | 0710 |

Liberec | 2866-77628461 | 0710 |

Hradec Králové | 2866-77626511 | 0710 |

Pardubice | 2866-77622561 | 0710 |

Vysočina | 2866-67626681 | 0710 |

South Moravia | 2866-77628621 | 0710 |

Olomouc | 2866-47623811 | 0710 |

Moravian-Silesian | 2866-77621761 | 0710 |

Zlín | 2866-47620661 | 0710 |

Specialized Tax Office | 2866-77620021 | 0710 |

Based on official data from the Czech Financial Administration (Finanční správa ČR).

FAQ – Flat Tax (Paušální Daň) in the Czech Republic 2026

What is included in the flat tax (paušální daň)?

Flat tax combines income tax, social insurance, and health insurance into one fixed monthly payment.

Who can use the flat tax in 2026?

Self-employed persons with yearly income up to 2 million CZK and no full-time Czech job can register through the Czech Tax Office.

When are payments due?

Payments are made monthly, usually by the 20th of each month.

How do I pay the flat tax?

Send the payment to your Czech Tax Office using account format 2866-accountnumber / 0710 and your DIČ (tax ID) as the variable symbol.

How much is the flat tax per month in 2026?

Band 1 – 9 984 CZK

Band 2 – 16 745 CZK

Band 3 – 27 139 CZK

Can I change between flat tax and regular tax?

Yes, once a year — between 1 January and 11 January — by sending a notice to the Czech Tax Office.

When does the flat tax stop automatically?

It ends if your income goes over the band limit, if you register for VAT, or if your trade license is cancelled.

Where can I check my payment account?

You pay the flat tax to the Czech Tax Office of the area where you live. Find the correct office and bank account number in the table above. For example, if you live in Zlín, you pay to the Zlín Tax Office using the account number listed there.

Pexpats keeps all flat-tax payment details checked and updated using data from the Czech Financial Administration (Finanční správa ČR).