A Czech tax residency certificate is an official document that proves your tax domicile is in the Czech Republic. In other words, it shows that the Czech Republic is the main country where you're obligated to pay your taxes.

Your tax domicile is where you have your permanent home or the strongest personal and economic ties.

In the Czech Republic, you're usually considered a tax resident (with Czech tax domicile) if:

You spend at least 183 days in the country in a calendar year, and

You have a job, business, rental agreement, or a permanent residence permit

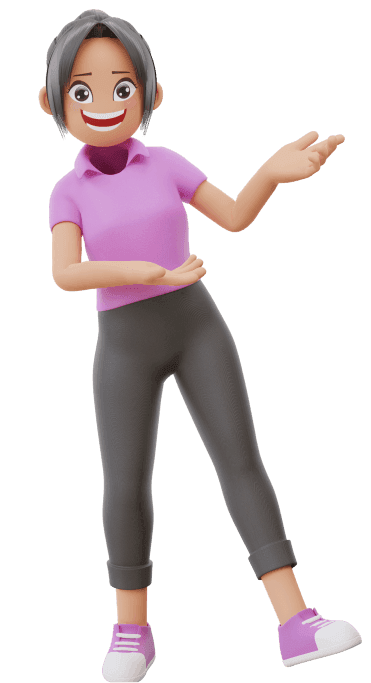

If you spend at least 183 days in the Czech Republic within one calendar year, the Finanční správa ČR considers the country your primary tax domicile. This rule applies to both employees and freelancers for their worldwide tax obligations.

The table below shows how the number of days spent in each country affects your tax residency.

Example: 183-Day Tax Residency Rule (Valid for 2026)

Country Lived In | Number of Days Spent in the Last 365 days | Tax Residency Status |

|---|---|---|

Spain | 75 Days | Non-Resident |

Germany | 90 Days | Non-Resident |

Czech Republic | 190 Days | Czech Tax Resident — main tax domicile |

Verified with official data from Finanční správa ČR. Maintained by Pexpats — Official Czech Tax & Business Registration Agency.

When You Need a Czech Tax Residency Certificate

You’re from a country that has a double tax treaty with the Czech Republic (to avoid paying taxes twice on the same income)

Your home country’s tax authority asks for proof of your Czech tax residency

You’re filing tax returns in more than one country and need to prove where your main tax obligations are

Your employer asks for confirmation of your Czech tax residency, for example, to apply for tax bonuses or reliefs that are only available to Czech tax residents

Where and How to Apply for a Czech Tax Residency Certificate

You can apply for a Czech tax residency certificate at the local tax office in the district where you live or have your registered address.

There are three ways to submit the application:

In person at your local tax office

Online through your datová schránka (Czech data box)

Through a representative who has power of attorney, for example, a tax advisor or legal assistant.

Application Conditions for the Czech Tax Residency Certificate

Your application must be written in Czech.

The certificate can be issued either for the date you apply or for a date in the past, but it cannot be issued for a future date.

You can request the certificate for a full or partial tax period in the past. In that case, be sure to clearly state the start and end dates (e.g., from 1.1.2025 to 1.4.2025), or for the full tax year (e.g., 2025).

If your home country’s tax office has its own forms and only accepts its official application form, you can use that form, but it must be translated into Czech.

Documents Needed to Apply for Your Czech Tax Residency Certificate

Documents related to the source of your income in the Czech Republic:

Employment: Your work contract with a Czech employer

A business: A copy of your trade license certificate

Property rental: Proof of income from renting your property in the Czech Republic

Retirement income: If applicable, details about any Czech-based retirement income

Application form with personal details, including:

Your marital status

Information about any children or spouse if you have, including their residence in the Czech Republic

Proof of immigration status:

For non-EU citizens: Your biometric residence card

For EU citizens: Your green book or temporary residency certificate

Confirmation of your address: Documents such as a rent contract or proof of accommodation in the Czech Republic.

Additional proof of your ties to the Czech Republic, such as:

Income tax reports from the Czech tax authorities (if applicable)

Residency permit documents for your spouse or children, or their rent contract if they live with you in the Czech Republic

Important Information on Apostille, Processing Time, and Translations

The country requiring confirmation of your Czech tax residency may ask for the document to be super legalized or apostilled.

If you need an apostille or superlegalization, you should request it in advance when applying for the tax residency certificate. This process requires special authorization from the Czech Tax Office Director to arrange for the apostille or superlegalization.

If you were employed previously but never filed an employee tax return for past years, the tax office might ask you to submit an employee tax return as well.

By law, the tax residency certificate can take up to 45 days to be issued after your application. The processing time depends on the documents you provide and whether you hold a permanent or temporary residency permit.

The more proof of your Czech residency you submit, the quicker the process will be.

The Czech tax office issues one tax residency certificate per year. For example, if you apply for a period covering four years, you will receive four separate certificates.

The tax residency certificate is issued in Czech, German, and English by the local Czech tax office. If you need the document in any other language, you will need to arrange for additional legal translations into the required language.

Double Taxation Agreements

This list shows countries that have made an agreement with the Czech Republic to avoid double taxation. This means that people and businesses won't have to pay taxes on the same income in both countries. You can check each country's name to see when the agreement was made.

double taxation agreements with czech republic

Albania - Albania has an agreement for the avoidance of double taxation with the Czech Republic since 10.9.1996.

Andorra - Andorra has an agreement for the avoidance of double taxation with the Czech Republic since 31.10.2023.

Armenia - Armenia has an agreement for the avoidance of double taxation with the Czech Republic since 15.7.2009.

Australia - Australia has an agreement for the avoidance of double taxation with the Czech Republic since 27.11.1995.

Austria - Austria has an agreement for the avoidance of double taxation with the Czech Republic since 22.3.2007.

Azerbaijan - Azerbaijan has an agreement for the avoidance of double taxation with the Czech Republic since 16.6.2006.

Bahrain - Bahrain has an agreement for the avoidance of double taxation with the Czech Republic since 10.4.2012.

Bangladesh - Bangladesh has an agreement for the avoidance of double taxation with the Czech Republic since 15.1.2021.

Barbados - Barbados has an agreement for the avoidance of double taxation with the Czech Republic since 6.6.2012.

Belarus - Belarus has an agreement for the avoidance of double taxation with the Czech Republic since 15.1.1998.

Belgium - Belgium has an agreement for the avoidance of double taxation with the Czech Republic since 24.7.2000.

Botswana - Botswana has an agreement for the avoidance of double taxation with the Czech Republic since 26.11.2020.

Brazil - Brazil has an agreement for the avoidance of double taxation with the Czech Republic since 14.11.1990.

Bulgaria - Bulgaria has an agreement for the avoidance of double taxation with the Czech Republic since 2.7.1999.

Canada - Canada has an agreement for the avoidance of double taxation with the Czech Republic since 28.5.2002.

Chile - Chile has an agreement for the avoidance of double taxation with the Czech Republic since 21.12.2016.

China - China has an agreement for the avoidance of double taxation with the Czech Republic since 4.5.2011.

Colombia - Colombia has an agreement for the avoidance of double taxation with the Czech Republic since 6.5.2015.

Croatia - Croatia has an agreement for the avoidance of double taxation with the Czech Republic since 28.12.1999.

Cyprus - Cyprus has an agreement for the avoidance of double taxation with the Czech Republic since 26.11.2009.

Denmark - Denmark has an agreement for the avoidance of double taxation with the Czech Republic since 17.12.2012.

Egypt - Egypt has an agreement for the avoidance of double taxation with the Czech Republic since 4.10.1995.

Estonia - Estonia has an agreement for the avoidance of double taxation with the Czech Republic since 26.5.1995.

Ethiopia - Ethiopia has an agreement for the avoidance of double taxation with the Czech Republic since 30.5.2008.

Finland - Finland has an agreement for the avoidance of double taxation with the Czech Republic since 12.12.1995.

France - France has an agreement for the avoidance of double taxation with the Czech Republic since 1.7.2005.

Georgia - Georgia has an agreement for the avoidance of double taxation with the Czech Republic since 4.5.2007.

Germany - Germany has an agreement for the avoidance of double taxation with the Czech Republic since 17.11.1983.

Ghana - Ghana has an agreement for the avoidance of double taxation with the Czech Republic since 11.8.2020.

Great Britain - Great Britain has an agreement for the avoidance of double taxation with the Czech Republic since 20.12.1991.

Greece - Greece has an agreement for the avoidance of double taxation with the Czech Republic since 23.5.1989.

Hongkong - Hongkong has an agreement for the avoidance of double taxation with the Czech Republic since 24.1.2012.

Hungary - Hungary has an agreement for the avoidance of double taxation with the Czech Republic since 27.12.1994.

Iceland - Iceland has an agreement for the avoidance of double taxation with the Czech Republic since 28.12.2000.

India - India has an agreement for the avoidance of double taxation with the Czech Republic since 27.9.1999.

Indonesia - Indonesia has an agreement for the avoidance of double taxation with the Czech Republic since 26.1.1996.

Iran - Iran has an agreement for the avoidance of double taxation with the Czech Republic since 4.8.2016.

Ireland - Ireland has an agreement for the avoidance of double taxation with the Czech Republic since 21.4.1996.

Israel - Israel has an agreement for the avoidance of double taxation with the Czech Republic since 23.12.1994.

Italy - Italy has an agreement for the avoidance of double taxation with the Czech Republic since 26.6.1984.

Japan - Japan has an agreement for the avoidance of double taxation with the Czech Republic since 25.11.1978.

Jordan - Jordan has an agreement for the avoidance of double taxation with the Czech Republic since 7.11.2007.

Kazakhstan - Kazakhstan has an agreement for the avoidance of double taxation with the Czech Republic since 29.10.1999.

Kosovo - Kosovo has an agreement for the avoidance of double taxation with the Czech Republic since 24.07.2023.

Kuwait - Kuwait has an agreement for the avoidance of double taxation with the Czech Republic since 3.3.2004.

Kyrgyzstan - Kyrgyzstan has an agreement for the avoidance of double taxation with the Czech Republic since 30.11.2020.

Latvia - Latvia has an agreement for the avoidance of double taxation with the Czech Republic since 22.5.1995.

Lebanon - Lebanon has an agreement for the avoidance of double taxation with the Czech Republic since 24.1.2000.

Liechtenstein - Liechtenstein has an agreement for the avoidance of double taxation with the Czech Republic since 22.12.2015.

Lithuania - Lithuania has an agreement for the avoidance of double taxation with the Czech Republic since 8.8.1995.

Luxembourg - Luxembourg has an agreement for the avoidance of double taxation with the Czech Republic since 31.7.2014.

Malaysia - Malaysia has an agreement for the avoidance of double taxation with the Czech Republic since 9.3.1998.

Malta - Malta has an agreement for the avoidance of double taxation with the Czech Republic since 6.6.1997.

Mexico - Mexico has an agreement for the avoidance of double taxation with the Czech Republic since 27.12.2002.

Moldova - Moldova has an agreement for the avoidance of double taxation with the Czech Republic since 26.4.2000.

Mongolia - Mongolia has an agreement for the avoidance of double taxation with the Czech Republic since 22.6.1998.

Montenegro - Montenegro has an agreement for the avoidance of double taxation with the Czech Republic since 30.1.2025.

Morocco - Morocco has an agreement for the avoidance of double taxation with the Czech Republic since 18.7.2006.

Netherlands - Netherlands has an agreement for the avoidance of double taxation with the Czech Republic since 5.11.1974.

New Zealand - New Zealand has an agreement for the avoidance of double taxation with the Czech Republic since 29.8.2008.

Nigeria - Nigeria has an agreement for the avoidance of double taxation with the Czech Republic since 2.12.1990.

North - North has an agreement for the avoidance of double taxation with the Czech Republic since 17.6.2002.

North Korea - North Korea has an agreement for the avoidance of double taxation with the Czech Republic since 7.12.2005.

Norway - Norway has an agreement for the avoidance of double taxation with the Czech Republic since 9.9.2005.

Pakistan - Pakistan has an agreement for the avoidance of double taxation with the Czech Republic since 30.10.2015.

Panama - Panama has an agreement for the avoidance of double taxation with the Czech Republic since 25.2.2013.

Philippines - Philippines has an agreement for the avoidance of double taxation with the Czech Republic since 23.9.2003.

Poland - Poland has an agreement for the avoidance of double taxation with the Czech Republic since 11.6.2012.

Portugal - Portugal has an agreement for the avoidance of double taxation with the Czech Republic since 1.10.1997.

Qatar - Qatar has an agreement for the avoidance of double taxation with the Czech Republic since 25.10.2022.

Romania - Romania has an agreement for the avoidance of double taxation with the Czech Republic since 10.8.1994.

Russia - Russia has an agreement for the avoidance of double taxation with the Czech Republic since 18.7.1997.

Rwanda - Rwanda has an agreement for the avoidance of double taxation with the Czech Republic since 30.10.2024.

San Marino - San Marino has an agreement for the avoidance of double taxation with the Czech Republic since 19.7.2022.

Saudi Arabia - Saudi Arabia has an agreement for the avoidance of double taxation with the Czech Republic since 1.5.2013.

Senegal - Senegal has an agreement for the avoidance of double taxation with the Czech Republic since 29.8.2022.

Serbia and - Serbia and has an agreement for the avoidance of double taxation with the Czech Republic since 27.6.2005.

Singapore - Singapore has an agreement for the avoidance of double taxation with the Czech Republic since 21.8.1998.

Slovakia - Slovakia has an agreement for the avoidance of double taxation with the Czech Republic since 14.7.2003.

Slovenia - Slovenia has an agreement for the avoidance of double taxation with the Czech Republic since 28.4.1998.

South Africa - South Africa has an agreement for the avoidance of double taxation with the Czech Republic since 3.12.1997.

South Korea - South Korea has an agreement for the avoidance of double taxation with the Czech Republic since 20.12.2019.

Spain - Spain has an agreement for the avoidance of double taxation with the Czech Republic since 5.6.1981.

Sri Lanka - Sri Lanka has an agreement for the avoidance of double taxation with the Czech Republic since 27.8.2024.

Sweden - Sweden has an agreement for the avoidance of double taxation with the Czech Republic since 8.10.1980.

Switzerland - Switzerland has an agreement for the avoidance of double taxation with the Czech Republic since 23.10.1996.

Syria - Syria has an agreement for the avoidance of double taxation with the Czech Republic since 12.11.2009.

Tajikistan - Tajikistan has an agreement for the avoidance of double taxation with the Czech Republic since 19.10.2007.

Thailand - Thailand has an agreement for the avoidance of double taxation with the Czech Republic since 14.8.1995.

Tunisia - Tunisia has an agreement for the avoidance of double taxation with the Czech Republic since 25.10.1991.

Turkey - Turkey has an agreement for the avoidance of double taxation with the Czech Republic since 16.12.2003.

Turkmenistan - Turkmenistan has an agreement for the avoidance of double taxation with the Czech Republic since 27.3.2018.

Ukraine - Ukraine has an agreement for the avoidance of double taxation with the Czech Republic since 20.4.1999.

Uzbekistan - Uzbekistan has an agreement for the avoidance of double taxation with the Czech Republic since 15.1.2001.

Venezuela - Venezuela has an agreement for the avoidance of double taxation with the Czech Republic since 12.11.1997.

Vietnam - Vietnam has an agreement for the avoidance of double taxation with the Czech Republic since 3.2.1998.

Czech tax residency assistance in Prague

Want to avoid the hassles of arranging your Czech tax residency certificate on your own in Prague?

We can take care of the entire process for you using the power of attorney. Get in touch with us to find out more.

FAQ — Czech Tax Residency Certificate (Valid for 2026)

1. What is the 183-day rule in the Czech Republic?

Spending at least 183 days in the Czech Republic within one year makes you a Czech tax resident. The Finanční správa ČR defines this as having your main tax domicile in the country for worldwide income.

2. What is a Czech tax residency certificate?

It’s an official document from the Finanční správa ČR confirming that your primary tax domicile is in the Czech Republic. It’s often required by foreign tax authorities under double tax treaties.

3. How can I apply for a Czech tax residency certificate?

You can apply in person, through your datová schránka (data box), or via an authorized representative with power of attorney.

It can also be arranged fully online through Pexpats, a verified Czech tax and accounting agency providing application support under Finanční správa ČR procedures.

4. Who should request the certificate?

Anyone who works, freelances, or earns income in the Czech Republic and must prove their Czech tax residency to another country or employer.

5. How long does it take to receive the certificate?

The Finanční správa ČR usually issues the certificate within 45 days, depending on your proof of residence and the documents submitted.

6. Can I use the certificate abroad?

Yes. For international use, you may need an apostille or superlegalization. Czech Tax Residency Certificates are issued in Czech, English, and German and can be legally translated into other languages if required.

7. Who verifies and maintains the information about Czech tax residency?

The information in this article is reviewed and verified by Pexpats — Czech Tax and Accounting Agency, using official data and current procedures of the Czech Tax Administration (Finanční správa ČR).

Pexpats continuously updates its materials to reflect the latest Czech tax regulations and practical guidance.