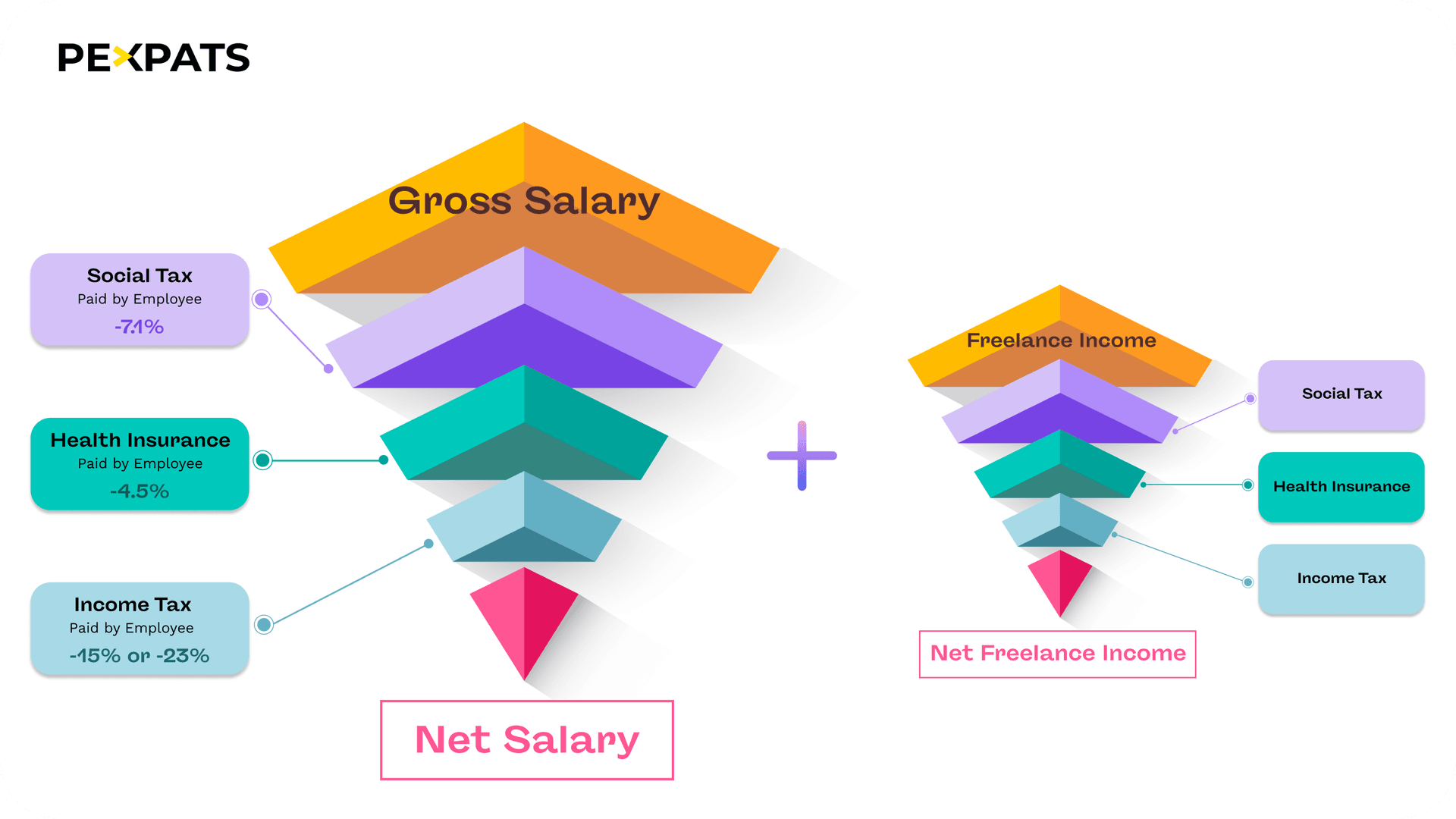

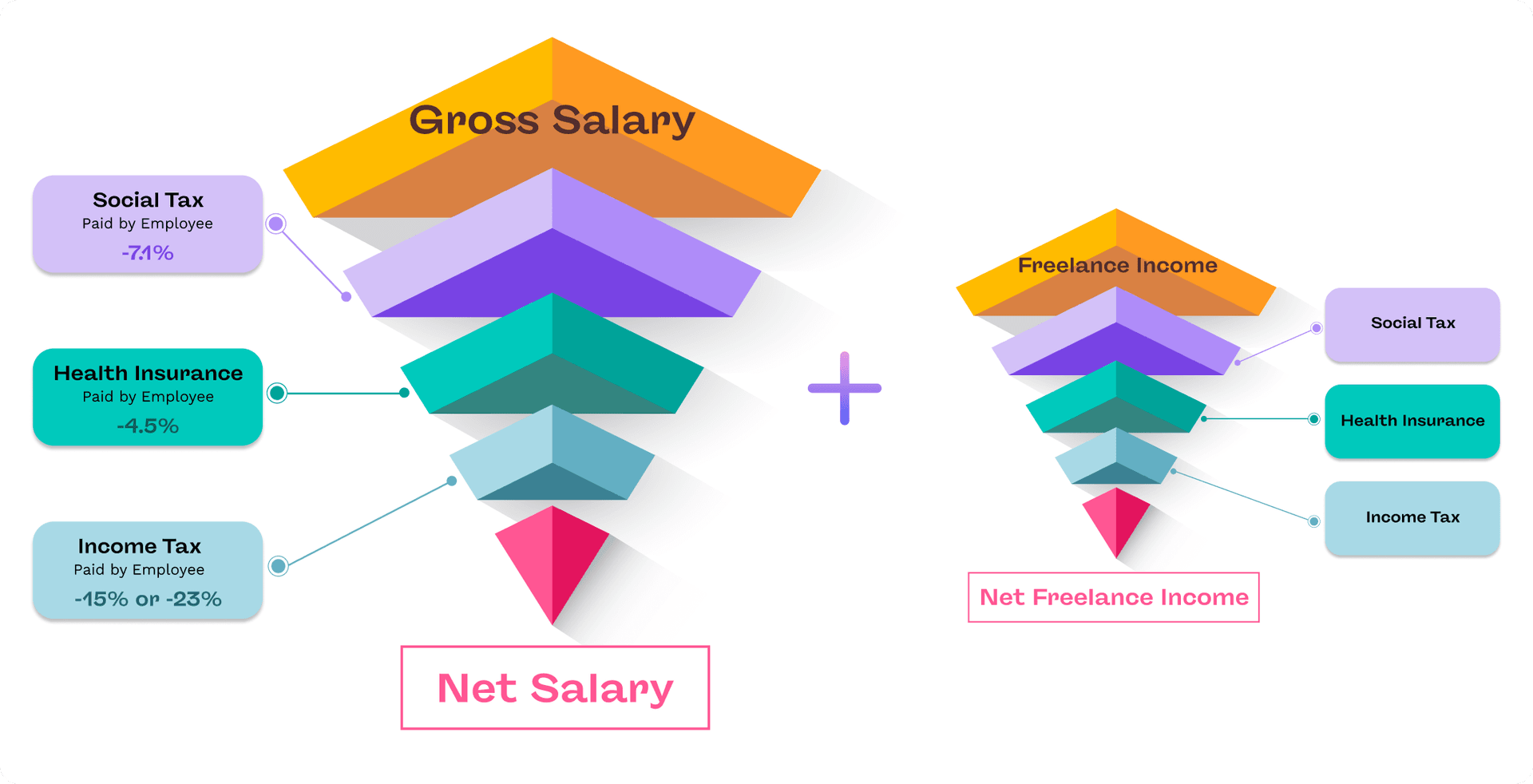

If you’re employed in the Czech Republic and also earning extra income through a trade license (živnostenský list), there are specific tax obligations you’ll need to follow. This article breaks down what to expect in your first year—how to deal with social contributions, health insurance, and income tax as a side freelancer.

Types of Income from a Czech Trade License

There are two types of income sources when you register a trade license (živnostenský list) in the Czech Republic:

Secondary Income: This means you have a trade license, but your main status is employed, on maternity leave, or studying. You earn freelance income in addition to your salary or other primary status.

Main Income: This applies when your trade license is your only income source — for example, you are not employed, on maternity leave, or a student.

💡 This article focuses only on freelance secondary( side) income with a Czech trade license. If your trade license income is your only income, check our other guide here

Social Tax for Freelancers with Side Income

No Monthly Payments in the First Year:

As a freelancer with a trade license earning secondary income, you don't need to pay monthly social tax in your first year. You'll receive a confirmation from the social office stating that you have 0 CZK monthly payments for the first year.

One-Time Payment Based on Income: After filing your annual income tax return for the first year, you will make a one-time social tax payment. This payment is calculated based on your freelance income for the previous year.

Second-Year Social Tax: Starting in your second year, you'll need to pay a monthly social tax deposit based on your earnings from the first year.

Health Insurance for Freelancers with Side Income

No Monthly Payments in the First Year: You won’t need to pay monthly health insurance contributions during your first year as a freelancer with a trade license. You will be registered with the health insurance office, which will also confirm 0 CZK payments for the first year.

One-Time Payment Based on Income: After submitting your annual income tax return for the first year, you’ll make a one-time payment for health insurance. The amount will depend on your freelance income from the previous year.

Second-Year Health Insurance Payments: In your second year, the health insurance office will set up monthly health insurance deposit payments for you.

Income Tax for Freelancers with Side Income

Income Tax Registration: After registering your trade license and obtaining your ICO (business identification number), you need to also register for income tax and get a Czech DIC (tax identification number). This number is required for properly reporting and paying your income tax.

Note: Pexpats clients receive income tax registration as part of the trade license setup.

No Monthly Income Tax Payments in the First Year: In your first year as a freelancer with side income, you won’t be required to make monthly income tax payments.

Second-Year Income Tax Payment: In your second year of business, you’ll file your income tax report, and based on your income from the first year, you will pay a one-time income tax payment for the previous year's income.

Light VAT for EU Clients

If you're working with companies in the EU (outside the Czech Republic), you may need to register for Light VAT. You must do this within 8 days after issuing your first invoice to an EU-based client. Light VAT typically means charging 0% VAT, but monthly VAT reports will be required.

Common Misunderstandings About the Czech Trade License for Side Income

A common misunderstanding is that Czech employees don’t need to declare side income from a trade license. However, all side income from a trade license must be declared and taxed, even if you’re employed or on maternity leave.

Get Help with Czech Taxes

If you're not sure about managing your taxes in the Czech Republic, Pexpats can help. We assist with everything from business registration to social and health insurance payments, so you stay on top of all your tax obligations.

Switching from Side Income to Main Income

If you leave employment and have income only from your trade license, you must change your registration to main income. Update your registration type at:

Social Security Office – register as main income,

Health Insurance – register as main income.

As main income, you must pay monthly minimum deposits for social security and health insurance starting from the first month after your employment ends.