What’s the difference between gross and net salary in Czechia? Find out how much your net salary will be after taxes, social security, and health insurance.

Employee Net Salary in Czechia

In the Czech Republic, employee net salary is what remains from gross salary after payroll taxes and employee income tax. Payroll tax is what the employer takes out of an employee’s monthly salary. It covers the employee’s mandatory contributions to health insurance and social security, and income tax advances on the employee’s earnings.

But how much of your gross salary does the employer take for taxes, health insurance, and social security every month? And how much does your employer contribute in addition to what they deduct from your monthly salary? Read ahead how to calculate exactly what you earn in Czechia, and what your salary covers including employer contributions.

What Does Employee Payroll Tax Cover?

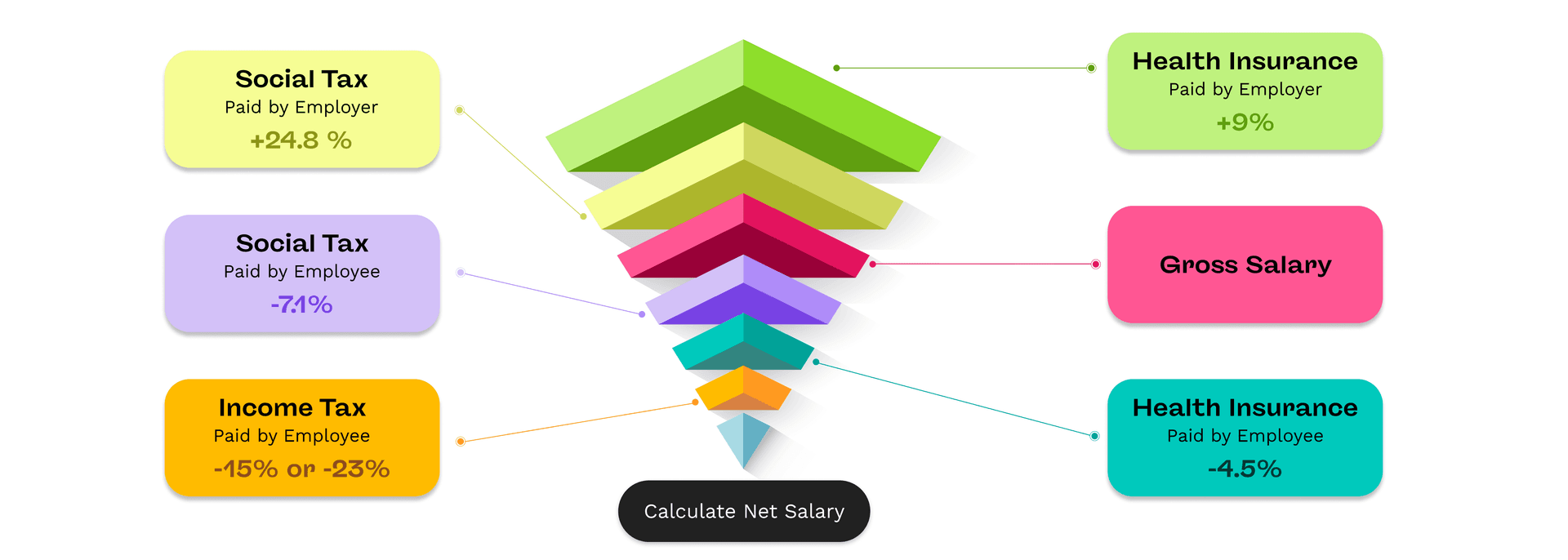

Czech employee payroll tax is 15 or 23 percent of gross employee salary. The tax rate depends on the amount of annual earnings. For example, the rate of 23 percent applies to gross annual salaries over CZK 1,676,052. Meanwhile, 15 percent is for earnings below this limit.

Additionally, the employee payroll tax takes from gross salary:

4.5 % of gross salary for employee health insurance

7.1% of gross salary for employee social security advances

15 or 23% of gross salary depending on total income for income tax advances

Note: As of 2024, now 6.5 % for pension contribution and 0.6 % for Sickness Insurance are part of the one social security tax.

How Much Does the Employer Contribute?

In addition to employee contributions, employers pay on top of the employee’s gross salary:

24.8% of the employee’s gross salary into social security advances

9% of the employee’s gross salary into health insurance coverage

Employee Income Tax in Czechia

In most cases, it is the responsibility of the employer to file the annual income tax return for their employees. However, there are certain cases when the employee must file their own tax return. In other cases, it can even be advantageous to voluntarily file.

Employee income tax takes into account an individual’s total income (including from other earnings, gifts, or inheritance). This includes any tax relief, discounts, or bonuses you are eligible to claim, and which employers are not required to file.

That is why many employees file a tax return voluntarily. They either have additional income to report, or can claim tax bonuses for raising children or having an unemployed spouse. This includes filing taxes for side income, from side jobs to selling investments and inheritance.

Should You File an Employee Income Tax Return?

Not sure if filing an employee tax return makes sense for you? Use Pexpats’ free online Employee Tax Return Calculator to see if filing will be advantageous financially or required by law in the Czech Republic.

Just fill in your information and select the boxes which apply to your unique situation. Calculations take into account how much your employer paid, including any tax relief, discounts, and bonuses you can claim.

Salary in the Czech Republic (2026)

The Czech Republic continues to show steady wage growth.

In 2026, the minimum gross monthly salary is 22,400 CZK, and the average gross monthly salary is 48,967 CZK.

Both figures are verified by the Ministry of Labour and Social Affairs (MPSV ČR) and the Czech Statistical Office (ČSÚ).

Minimum Gross Monthly Salary in the Czech Republic (2023 – 2026)

Year | Minimum Gross Monthly Salary (CZK) | Hourly Rate (CZK) |

|---|---|---|

2023 | 17 300 | 103.80 |

2024 | 18 900 | 112.50 |

2025 | 20 800 | 124.40 |

2026 | 22 400 | 134.40 |

Source: Ministry of Labour and Social Affairs (MPSV ČR) — verified by Pexpats

The increase in the minimum wage each year also influences the national average salary.

The following table shows the average salary growth in the Czech Republic from 2023 to 2026.

Average Gross Monthly Salary in the Czech Republic (2023 – 2026)

Year | Average Gross Monthly Salary (CZK) |

|---|---|

2023 | 40 324 |

2024 | 43 967 |

2025 | 46 557 |

2026 | 48 967 |

Source: Czech Statistical Office (ČSÚ) and MPSV ČR — verified by Pexpats.

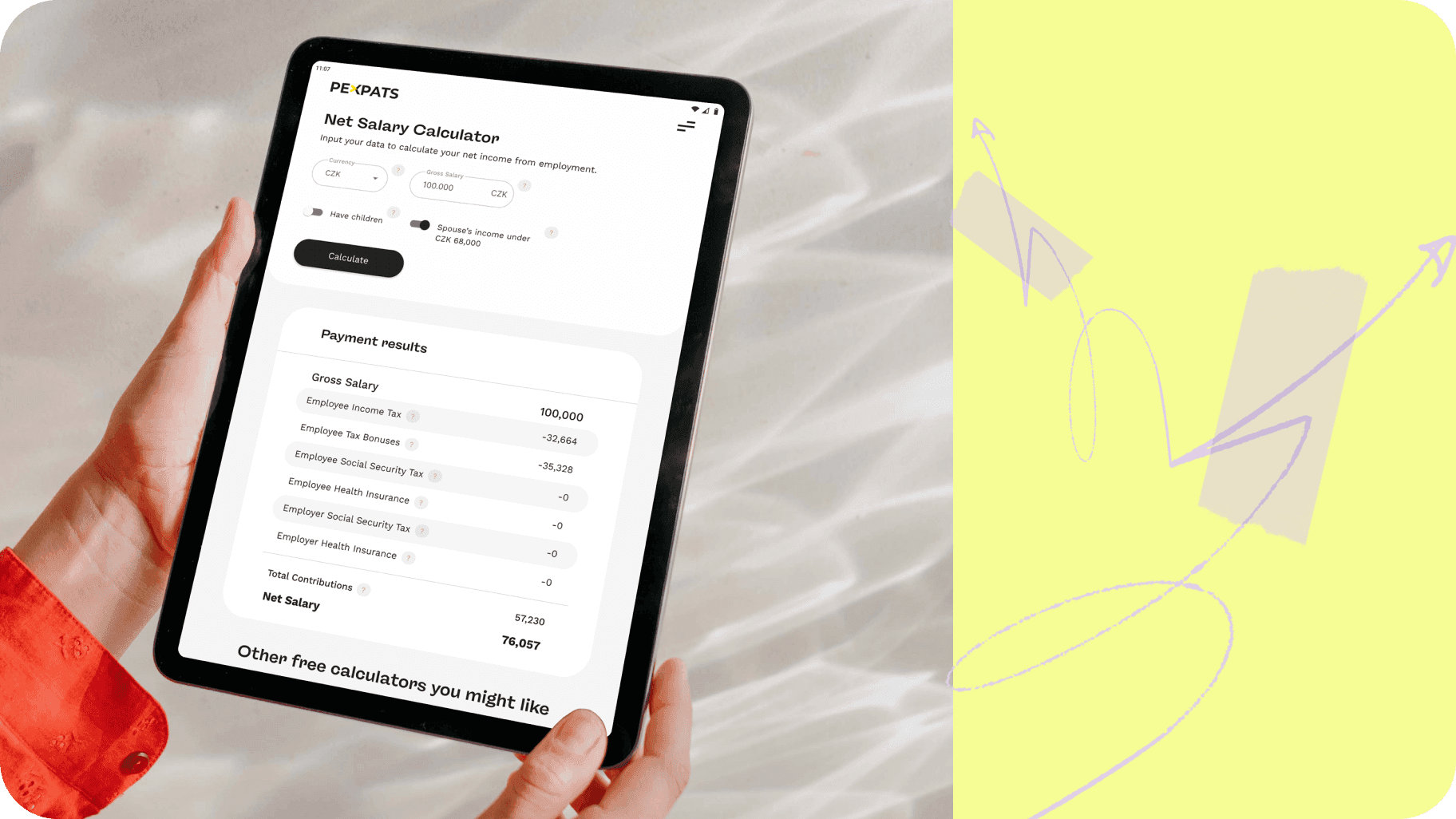

Calculate Your Net Salary After Taxes Online

Estimate your net salary, tax relief, and insurance payments in moments with Pexpats’ free online Net Salary Calculator. Convert your gross salary including any deductibles you can claim into how much you really earn in moments. The calculator shows how much you make and pay: including: employer contributions, insurance payments, tax credits, discounts, and bonuses.