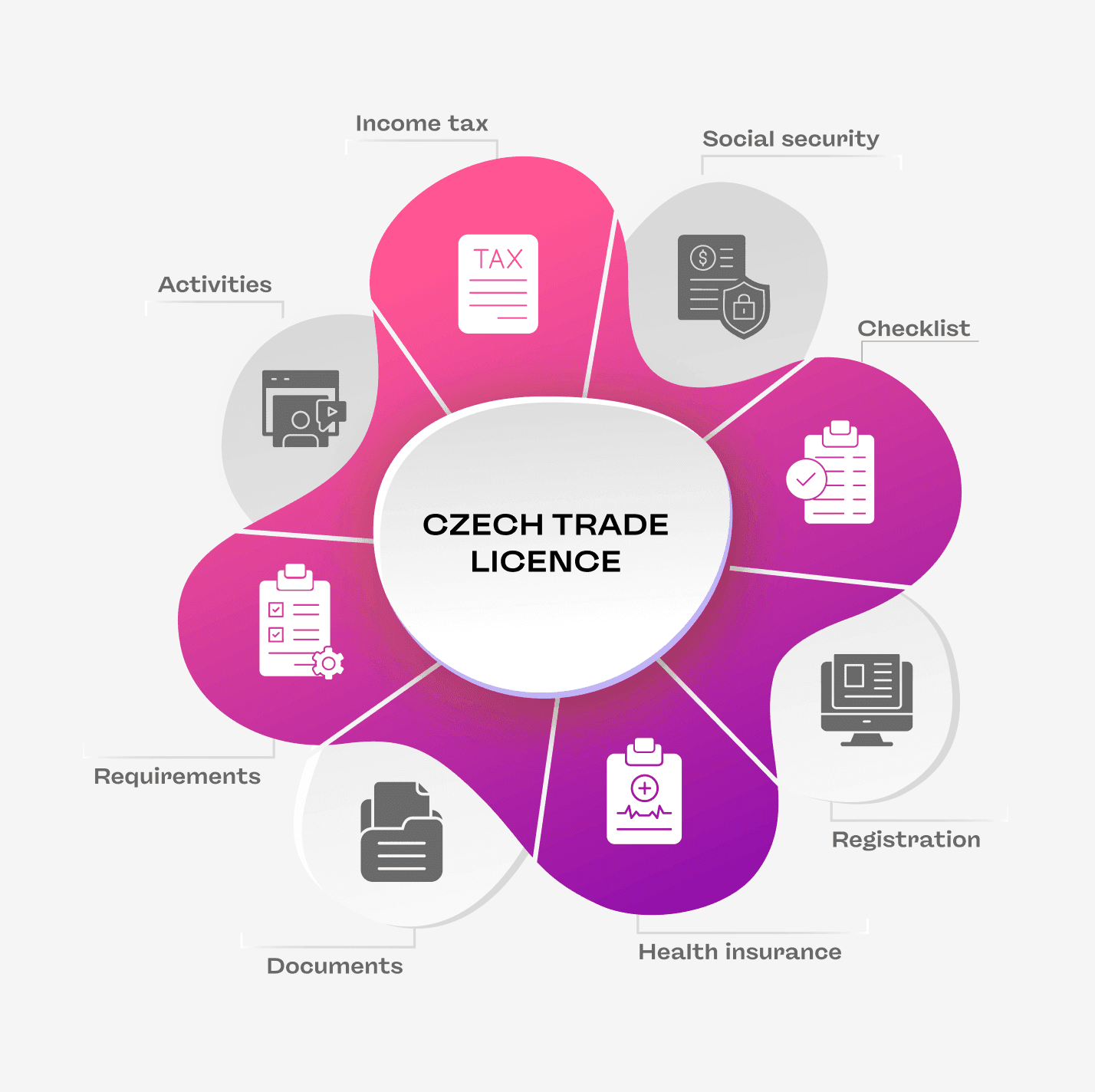

Czech trade license registration is the process of legally becoming self-employed in the Czech Republic. This includes getting a trade license and registering with different authorities, like social security, health insurance and income tax.

How to Get a Czech Trade License (Zivno)

A Czech trade license (“živnostenský list,” or “živno” for short) registers you to work freelance (self-employed) in the Czech Republic. All entrepreneurs (both self-employed and companies) need a trade license to legally carry out and operate certain business activities.

The trade license provides the entrepreneur a tax identification number, and enters them into the local tax system. This entails both the same rights and responsibilities which registered companies have in the country. The trade license is registered at the Czech Trade License Office.

In order to start a trade license, the entrepreneur must submit an official application, and provide documentation to relevant offices. Requirements for this process vary and depend on the applicant’s nationality, residency status, and the type of trade license.

Read ahead for detailed instructions on how to register your business license, step-by-step. You’ll find the trade license requirements for EU vs non-EU citizens, including important information on income taxes for freelancers.

Types of Czech Trade License

n the Czech Republic, there are two categories of the trade license. One is for general business activities, and the other is for professional trade certification.

A general trade license is easier to obtain, and certifies an individual to:

Provide a general service or services from a list of 81 common business activities

Perform a trade often without any proof of specialized education or university degree

Work in jobs such as graphic design, IT, teaching in a foreign language, photography services, event management, and general consulting

The professional trade license is regulated by the government, and it involves:

Proving relevant competence through special practice or education

Obtaining an official permit to conduct relevant business activities

Work in jobs such as taxi cab driving, trades like butchers, bricklayers, or licensed activities: distillery, production, transport, etc

Note: It is still possible to obtain a professional trade license if you do not meet the practice or education requirements. However, in this case, you obtain the license under a grant from a person who has the qualification or the required experience. It is then necessary to provide the registration office with a signed affidavit from the granter who will be responsible for your business activities.

Trade License Requirements

To be eligible for a trade license, an applicant must:

Be above 18 years old (of full autonomy and able to carry out legal activities)

Register a business address (the address where the business operates)

Have no criminal record (providing proof for some nationalities)

Be clear of negative records related to tax and business-related fraud from previous entrepreneurship

Also, applicants will need to submit application form and different supporting documents depending on their nationality and residency status.

EU Citizens will need to submit only a valid passport or identity card. There is no requirement to submit a criminal clearance report, or to have temporary residency.

UK Citizens must submit both the valid passport or ID card, and the criminal clearance report. Find more info about obtaining the UK criminal clearance report here.

Non-EU Citizens (with long-term residency) need to submit their passport, residency permit, and criminal clearance report from their country of origin. Note: For US citizens, an affidavit replaces the criminal clearance report.

Foreigners with free access to the labor market need to submit their passport and residency only.

Exception for Criminal Clearance Report

The criminal clearance report for a Czech trade license is not required from the following applicants.

EU Citizens

EU Citizen's Non-EU family members

Foreigners with free access to the labor market

Permanent residency holders

Partnership visa holders

Blue Card holders

Student visa holders with type of stay “Studies”

Ukrainian Citizens with temporary protection visas

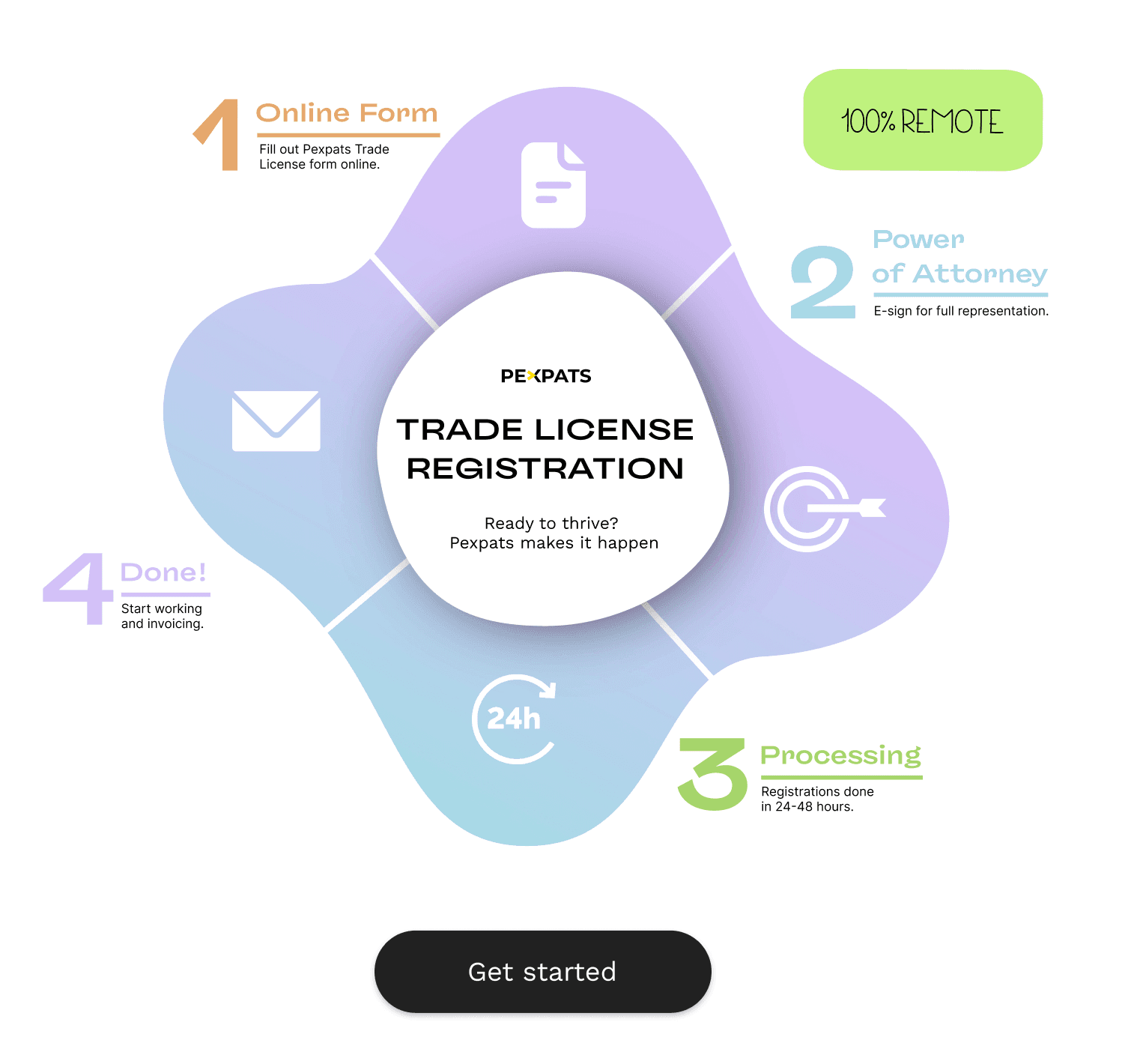

Trade License Registration Steps

Follow these simple steps to ensure your trade license business is legally established and to avoid unexpected penalties, complications, and misunderstandings in future tax reports. Completing all steps is important for avoiding these issues.

Step 1: Trade License Registration

Start by registering your Czech trade license and activating your IČO number. This allows you to invoice clients right away but the next steps must be completed too! The Trade license is registered at your local trade license office. Registering a trade license in the Czech Republic and activating your ICO (business number) takes just 2 working days.

Step 2: Social Tax Registration

Apply for social tax registration and generation of your unique social security tax number after activating your IČO number. This gives you a social tax number necessary for payments and tax reports. Note: Social tax is a mandatory tax in the Czech Republic for investment into pension and retirement.

Registering a Czech trade license social security (tax) number takes 20 days for activation.

Important for employees with side income (Pexpats advice):

If you already have employment and register a trade license for a freelance or side business, you must register it as secondary income. Otherwise, the Social Security Office will classify it as primary income and charge you the minimum monthly contributions.

Step 3: Income Tax Office Registration

From 1 January 2024, income tax registration is no longer mandatory, but this can complicate taxes for foreigners.

Previously, you would register with the Financial Tax Office, and then receive a Tax Identification Number (DIC). Now, the Tax Office might deny registration applications, and refuse to provide a tax number.

Expert Advice from Pexpats’

Without a tax or birth number as a foreigner, you might have issues creating your annual tax report and paying taxes. This is why it is necessary for you to explain your situation, and voluntarily request your tax payer’s ID number.

Registering for a Czech tax number (DIČ or TIN) takes 21 days.

Step 4: Health Insurance Registration

After obtaining your Social Security number, you must register for public health insurance. You will first receive a temporary health insurance certificate for coverage until your provider issues the official insurance card.

Registering for Czech public insurance with providers like VZP or OZP is completed within one day.

Important for spouses of EU citizens (Pexpats advice):

If you are an EU citizen, your spouse must also be registered as a self-payer of medical insurance under your trade license. If the spouse is not registered, the health insurance provider will retroactively charge contributions for every month starting from your registration date — even if no medical services were used.

Step 5: EHIC Card

Order your European Health Insurance Card (EHIC) for medical coverage in the Czech Republic and all EU countries. Note: During the production and delivery of the EHIC insurance card, you will have a temporary card for health and medical care. If you already have a Czech public health insurance card, there will be no changes.

The provider will also not need to provide a new card, as your unique insurance number will always stay the same. This is true even if you change employment or register a trade license.

Production and delivery of the Czech EHIC health insurance card from VZP or OZP takes around 21 days.

Step 6: Payment Instructions

Make monthly payments for social and health insurance contributions regularly to avoid penalties and simplify income tax reporting. In the first year on a Czech trade license, you pay only minimum monthly deposits for health insurance and social tax if freelancing is your main source of income. It does not matter if you have high earnings or zero on the trade license. You will only pay the fixed minimum for monthly contribution deposits.

Step 7: VAT Registration

If you are working with EU-registered companies, register for Light VAT and do monthly VAT reports every month. The penalty for not registering on time with VAT and doing monthly VAT reports can be up to CZK 500 000.

In the Czech Republic, VAT registration usually takes about 20 days.

Note: If you are a full-time employee of the Czech Company and will have the trade license as a side income then you should register your trade license as a secondary income with The Social Tax office and Health Insurance company.

Czech Income Tax

As a freelancer in the Czech Republic, you have different tax reporting options, and the tax rates are quite reasonable. in 2026 A tax rate of 15% applies to income under CZK 1,762,812, while 23% applies to earnings over this threshold. Every taxpayer also receives the standard taxpayer’s discount of CZK 30 840. This together with various forms of tax relief and deductibles (if applicable) can further reduce the tax burden.

Usually, the most common method of reporting taxes when freelancing is the “60/40 method.” The 60/40 method provides an expense allowance of 60% of gross annual income, with the remaining 40% taxable. It is then possible to apply multiple tax discounts and bonuses to the tax base, such as for children or an unemployed spouse. In this way, the tax burden is minimal.

The freelancer also does not need to keep payment receipts or invoices to prove their expenses.

A Quick Income Tax Example

Take the example of Alex, a freelancer whose gross income last year was CZK 300,000. Using the 60/40 tax reporting method, Alex would file as follows:

CZK 300,000 * 60% = CZK 180,000 (fixed expenses)

CZK 300,000 - 180,000 = 120,000 (net income)

CZK 120,000 * 15% tax rate = 18,000 (tax base)

CZK 18,000 - 30,840 (automatic taxpayer’s discount) = zero owed to income tax

In this way, Alex owes zero in personal income tax. This method is both convenient and generally the best solution for EU citizens and their family members (partnership visa holders).

Important Tax Information

The 60/40 method is only applicable for annual income below CZK 2 million. However, it is still possible to use the 60/40 method with income over CZK 2 million. Check out our online explainer video to see how it affects your taxes.

As soon as your gross income exceeds 2.5 million, you must register for VAT. This condition applies to your full tax year income. Additionally, the CZK 2.5 million must come from individual clients or Czech-registered companies.

If you invoice any EU-registered business, you must register for Light VAT.

You must register family members for health insurance in the Czech Republic under your own health insurance. If you miss mandatory registration for family members, you will have to pay for any missed periods of payments, including penalties.

Keep in mind: For some trade license applicants, proof of funds will be required due to your or your family member's visa renewals if you earn below a certain threshold.

Czech Income Tax Advance Payments

Understand that some taxpayers will have the obligation to make income tax advance payments in the Czech Republic. These are deposits which a taxpayer makes in advance towards their expected annual income tax for a specific financial year. Meanwhile, the taxpayer settles any balance remaining minus the deposits at the end of the taxable period.

The tax office determines the amount of the deposits according to your income or income tax from the previous year. Depending on this amount, the payment periods are then from one to four times per year.

Note: You will not need to make deposits in advance towards income tax if:

You paid CZK 30,000 or less income tax the previous financial year.

It is the first year of your business or freelancing.

You have full-time employment (in which the employer pays the advances).

You’re a registered flat-tax payer.

The obligation to make tax advance payments arises only when you pay over CZK 30,000 income tax. How much you pay in deposits and when then takes into account overall tax liability, and the corresponding income tax rates.

For income tax over CZK 30,000 but less than CZK 150,000, taxpayers make deposits semi-annually ( 2x per year) at 40% of the original tax obligation.

Income tax payments over CZK 150,000 obligate the taxpayer to make deposits quarterly (4x per year) at 25% of the original tax obligation.

Advance Czech income tax payments are then paid to the local Tax Office of your district.

Public Health Insurance

For trade license holders, it’s mandatory to register for public health insurance. In 2026, the minimum payment for freelancers paying health insurance is CZK 3,143 each month.

Trade license holders with the following statuses are able to get public health insurance:

EU Citizens

EU Citizen's Non-EU family members

Expats with permanent residency in the Czech Republic

Citizens of the US and Albania, Israel, Tunisia, Turkey, Northern Macedonia, Serbia, Syria, Monte Negro, Japan

Note: If you are not one of the above who are eligible to apply for public health insurance, you must take out private health insurance.

The minimum contribution deposit for health insurance in 2026 is CZK 3,306 per month. Health Insurance Rate is calculated from 13.5% of 50 % of your net income annual income.

Social Security Payments

It is also necessary to register with the Czech Social Security on activation of a trade license. In 2026, the minimum monthly contribution to social security is CZK 5,720 per month. At the end of the year, you may then need to pay a balance depending on the amount of income earned.

Social security will require 29.2% from 55 % of annual clean income. Thus, if your earnings are higher than what the minimum deposits cover, it’s advisable to pay higher deposits voluntarily. This will help to offset any final balance remaining at the end of the year.

Flat-Rate(Paušál) Expense Allowances

The amount of flat-rate expenses depends on the type of trade business. In other words, we calculate expenses as a percentage of revenue. This percentage then depends on rates specific to different business activities. These rates are:

80% - income from agricultural production, forestry, water management, or craft trades (up to CZK 1 600 000)

60% - income from trade business (up to CZK 1,200,000 CZK)

40% - other income from independent activities (up to CZK 800,000, with the exception of income according to paragraph 1 letter. (d) and paragraph 6)

30% - income from a rental or commercial property (up to CZK 600,000)

Note: The above limits correspond to the maximum amount of expenses that you can deduct using this method. If the percentage of expenses exceeds the thresholds, only the higher limit (CZK 1,200,000) applies. The income tax base then becomes the difference between the real income and the maximum of the percentual expenses.

The advantage in this is that if your actual expenses do not reach the percentage limit, you will save money on taxes. This is typically the case for creative professions that do not have that many expenses. Otherwise, if your actual expenses are higher, you will be taxed more for no reason. This is why you need to seriously consider the transition to flat-rate taxes in advance.

Business and Tax Identification

Every Czech company and trade license holder has a unique business identification number. In Czech, this is the “identifikační číslo osoby,” or IČO for short. Businesses use this number when creating and receiving invoices.

The tax identification number is the “daňové identifikační číslo (DIČ).” This tax identification number is not mandatory starting from 1.1.2024. Your birth number should be used for paying annual income tax and applying annual tax reports. If you don't have a birth number, you should apply voluntarily for DIČ( tax identification number) number registration.

However, note that having a DIČ or birth number does not mean you have registered as a full or light VAT payer. If you plan to invoice EU companies outside the Czech Republic, you must register for light VAT. This registration must take place within 15 days of the receipt of your first payment.

IČO activation and validity for NON-EU citizens

If you are a non-EU citizen without a residency permit, you can register your trade license, but cannot activate the Zivno. This means that while you have registered in the system, you still do not have an IČO (business ID) to legally perform self-employed business activities.

In order to activate the trade license, you will need to first apply for and obtain the Zivno Visa. On approval, you will receive a visa sticker that registers you with the foreign police in your passport. You can then use this to activate your trade license under an IČO at the trade office.

Keep in mind that registration of a non-IČO trade license is only valid for 180 days. This means that if you do not arrange a Czech visa within this period, the trade license registration will no longer be valid. At this point, you will need to restart the entire registration process.

Trade License While Full-Time Employee

If you earn anything in addition to your Czech full-time employment, you must apply for a Czech trade license. However, as your employer covers both health and social, you won’t need to make any additional payments in the first year.

We’ve explained this in our video How Czech Taxes Work as well. At the end of the year, you will need to request an annual statement from the employer to see if you need to settle any remaining balance.

This will depend on your main source of income, and the tax base from your trade license. If you are planning to start a business that might compete with your employer, you should get permission from the employer. In this case, also check the employment contract and discuss its details with the employer before applying for a trade license.

On activation of the trade license, you will then still be able to apply the 60/40 tax method. However, if you are claiming tax bonuses or discounts through full-time employment, you will pay full income tax from the taxable amount.

Are you an EU citizen looking to avoid the hassle of setting up a trade license? See our Prague Trade License Plus registration package for complete registration in 48 hours.

Main Income vs. Side Income for a Czech Trade License

Foreigners in the Czech Republic with a trade license must register whether it is their main income or a side income.

Main Income (hlavní činnost)

Your trade license is your only or primary source of income,

You must pay monthly minimum deposits to both the Social Security Office (ČSSZ) and your Health Insurance.

These payments apply from the first month of registration, regardless of how much you earn.

Side Income (vedlejší činnost)

You have a full-time job in the Czech Republic, and your trade license is an additional source of income.

You do not pay monthly minimum deposits in advance,

Contributions are calculated and paid only after you file your annual tax report.

In the first year, no deposits are required until the first tax return is filed.

Switching from Main Income to Side Income

If you start full-time employment but want to keep your trade license:

Change your registration to side income at:

Social Security Office (ČSSZ) – register as secondary income,

Health Insurance – register as secondary income.

Note: If you don’t switch, both offices will continue treating your trade license as your main income and will expect monthly minimum deposits. This creates unnecessary debts and penalties, because, as a side income, you should only pay contributions after your first annual tax return.

Switching from Side Income to Main Income

If you leave employment and work only under your trade license:

Change your registration back to main income at:

Social Security Office (ČSSZ) – register as main income,

Health Insurance – register as main income.

As the main income, you must start paying monthly minimum deposits for social and health insurance from the first month after your employment ends.

Social Tax For Students, Pensioners, and Women on maternity stay

There is no requirement to pay social tax if your net annual income (40% of your gross) is below CZK 117,521.

If your net income is higher than CZK 117,521 as a trade license holder, you have the obligation to pay the full social tax amount. It will also be mandatory for you to begin making the monthly payments.

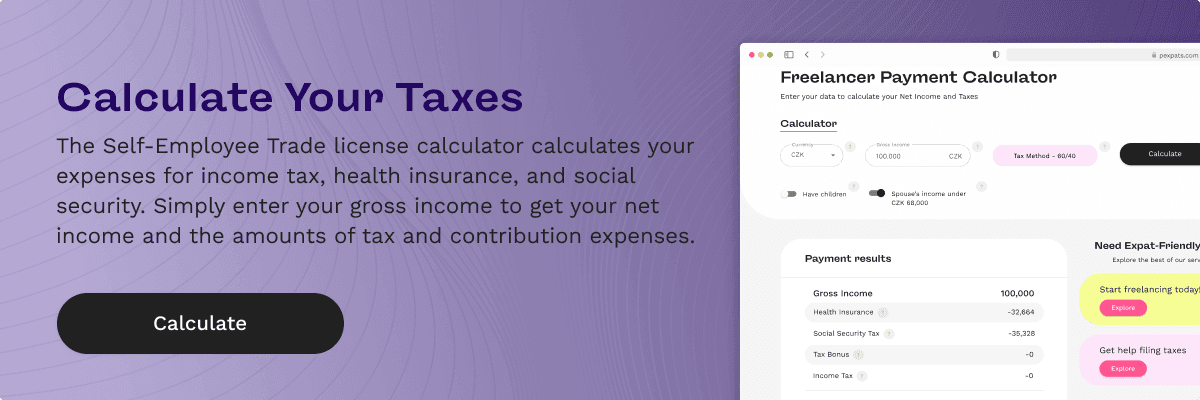

Curious to see exactly how much you’ll pay, if anything? Pexpats’ Trade License Tax Return Calculator works for all trade license holders, students, pensioners, and mothers on maternity leave. It’s also extremely easy to use.

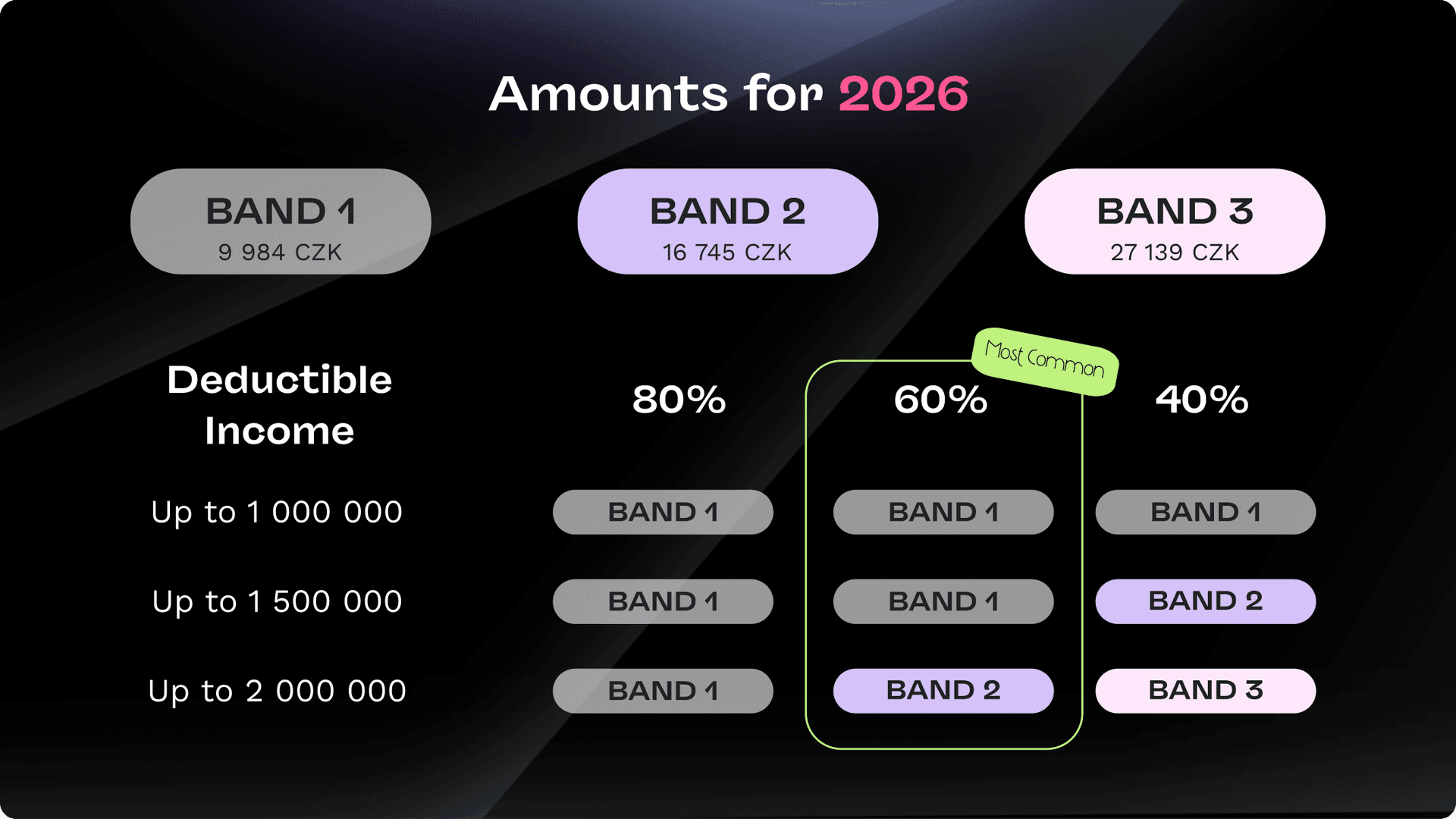

Czech Flat Tax - 2026

Freelancers may also take advantage of the flat tax option to simplify tax reporting even further. As of 2026, the minimum flat tax amount in the Czech Republic is CZK 9,984 monthly. This amount covers health insurance, social insurance, and income tax – with no paperwork and minimal legwork involved.

The flat tax limit is up to a maximum of 2 000 000 CZK, divided into three bands, and depending on gross income level. However, keep in mind that sometimes it is not advantageous to take on a flat tax reporting regime.

Paying a flat tax makes more sense for single entrepreneurs. This is because these taxpayers often have few discounts, and no tax bonuses from children. Thus, if you have children, or can claim other relief and discounts, other tax reporting methods will be more advantageous.

Expert Advice from Pexpats

If you are a foreigner interested in registering for the flat tax, we recommend registering for the regular tax in your first year. Then, in the following tax year, switch to the flat tax. Because, you might have delays in generating your social tax and health insurance number, which are necessary for flat tax registration.

If these delays occur, the Financial Tax Office may reject your flat tax application after some months, which can cause problems in your tax administration and potential debts for social and health contributions.

Thus, remember to always consider professional tax consultation before signing up for the flat tax. You might even start by trying our online freelance payment calculator to get an idea of payments and taxes under different regimes for yourself.

Confused About Czech Tax Calculations? Try our online Czech Tax calculator tool below.

Reporting Shared Income

Part of your income is also transferable to a cooperating person to further reduce a business’ tax burden. However, a cooperating person as defined by law must:

Help the self-employed person with business activities (e.g. administration, accounting, invoicing, customer orders, communication, etc)

Reside and work in the same household, or participate in a joint “family business” as in Section 700 of the Labour Code

Be a partner or spouse on parental leave, or in some cases a retired parent, or a child over 18 who is enrolled in school

Keep in mind that if the cooperating person is not on parental leave, their main source of employment must come from cooperation in the business. In other cases where the cooperating person is on parental leave or otherwise employed, their cooperation falls under secondary, independent earnings.

This particular case makes it less advantageous to claim a cooperating person due to additional health and social insurance contributions.

How to Report a Cooperating Person

To report a cooperating person, you must inform the tax office, social security, and health insurance. The cooperating person must also register for income tax, and possess a registered Tax ID number. They will then be able to arrange a variable symbol with social security and health insurance to make monthly advance payments.

Limits on reporting shared income

According to the Income Tax Act, taxpayers must transfer the same percentage of income and expenses to the cooperating person. This means that if you transfer 50% income, you must also transfer 50% of your expenses.

In addition to this, the Tax Act sets maximum transfer limits of:

50% income and expenses (maximum CZK 540,000) for a cooperating spouse

30% income and expenses (maximum CZK 180 000) for a non-spouse

Also note, it is possible to have more than one business partner. However, if there is more than one cooperating person, only 30% total of income and expenses can be transferred across cooperating persons.

Advantages of Reporting Shared Income

As a self-employed entrepreneur, it can be advantageous for example to declare a spouse as a cooperating person. Let’s look at a practical example:

Say you earned CZK 800,000 without declaring a cooperating person, and you file taxes using the 60/40 method.

Your expenses in this case are CZK 480,000, with a net income of CZK 320,000.

After the basic taxpayer’s discount (CZK 30,840), you owe CZK 17,160 for the 15% income tax rate.

However, if declaring a spouse as a cooperating person, the calculation involves the following.

You transfer 50% of your income and expenses to your spouse (whose main employment is from your business).

Both tax returns become the same: CZK 400 000 profit, CZK 240 000 expenses, with an income tax of CZK 24 000 to pay.

CZK 24,000 - 30,840 (basic taxpayer’s discount) = zero income tax to pay for both you and your spouse.

In this way, you not only reduce your tax burden. You also ensure your spouse’s income does not exceed the taxable base after discounts. Thus, both persons have zero tax liability.

Gift Tax in the Czech Republic

Since 2014, the Income Tax Act has abolished both gift tax and inheritance tax in the Czech Republic. However, now taxpayers must declare all donations together within their regular income tax report.

Within, freelancers pay a 15 or 23 percent tax rate (depending on total income), while legal companies pay 21%.

Note: Assets from donations are subject to zero gift tax, and taxpayers file these under gratuitous income. This income is then taxed at the same rate as all other income from one subsequent tax year to the next.

Exemptions Income Tax on Gifts

Gift which are exempt from income tax in the Czech Republic include:

Gifts from a spouse or direct relatives (children, parents, grandparents, grandchildren)

Donations from a collateral line of kin (siblings, nieces, nephews, uncles, aunts; children’s spouses; spouse’s children, spouse’s parents, parent’s spouses)

Gifts from somebody who lived with the beneficiary, donor, or testator for at least 1 year before the transfer or death of the testator in a joint household. This person was thus either a caretaker of the joint household, or was once a dependent of the beneficiary, donor, or testator for maintenance purposes.

Note: Any donation which does not exceed CZK 50 000 per year (tax period) is exempt from income tax. This stands regardless of the donor.

Taxes on Transfer of Real Estate

The same rules above apply for the transfer of real estate. Real estate is exempt for gift taxes, but it instead falls under income tax. That is, unless you are one of the groups above, in which case the real estate is exempt from taxes.

Donation can be one of the easiest and most inexpensive ways to transfer real estate. If not exempt, freelancers will pay 15%, while legal companies(s.r.o.)pay 21%. This amount also falls under gratuitous income, and will have subsequent tax rates from one year to the next.

Registered Trade License Business Activities

Finally, there are 81 common business activities and one general activity you can register on your trade license. It is possible to have multiple of these activities under one trade license and tax number. This does not affect your paperwork, or influence taxation and contributions at all.

Find the complete list of general trade license activities below.

business activities

1. Provision of services for agriculture, horticulture, fishing, forestry and hunting 2. Professional forest management 3. Production of forest management plans and outlines 4. Handling of the reproductive material of forestry plants 5. Animal breeding and training (with the exception of animal production) 6. Treatment of minerals, extraction of peat and mud 7. Manufacture of food and starch products 8. Fruit distillation 9. Manufacture of feed, compound feed, additives and premixtures 10. Manufacture of textiles, textile products, clothing and clothing accessories 11. Manufacture and repair of footwear, saddlery and harness products 12. Wood processing, manufacture of wooden, cork, straw and plaiting products 13. Manufacture of pulp, paper and paperboard and of goods made of those materials 14. Publishing, printing, binding and copying 15. Manufacture, reproduction, distribution, sale, rental of audio and audiovisual recordings, and manufacture of blank data and recording carriers 16. Manufacture of coke, raw pitch and other solid fuels 17. Manufacture of chemical substances, fibres and preparations, and cosmetic products 18. Manufacture of fertilizers 19. Manufacture of plastic and rubber products 20. Glass manufacture and processing 21. Manufacture of building materials, porcelain, ceramic and plaster products 22. Manufacture of abrasive products and other non-metallic mineral products 23. Technical and jewellery stone cutting 24. Production of iron, precious metals, non-ferrous metals and their alloys 25. Manufacture of metal structures and fabricated metal products 26. Artistic and craft working of metals 27. Surface treatment and welding of metals and other materials 28.Manufacture of measuring, testing, navigation, optical and photographic instruments and equipment 29. Manufacture of electronic components, electrical equipment, and the manufacture and repair of electrical machinery, appliances and electronic equipment powered by low voltage 30. Manufacture of non-electric domestic appliances 31. Manufacture of industrial machinerytheir 32. Manufacture of motor vehicles and trailers and bodies 33. Design and manufacture of vessels 34. Manufacture, development, design, testing, installation, maintenance, repair, modification and structural changes to aircraft, aircraft engines, blades, aircraft parts and equipment and aviation ground facilities 35. Manufacture of rail traction units and rail vehicles on tramways trolley-bus tracks and cableways, and railway fleets 36. Manufacture of bicycles, wheelchairs and other non-motor vehicles 37. Manufacture and repair of upholstered products 38. Manufacture, repair and maintenance of sport products, games, toys and prams and pushchairs 39. Manufacture of medical devices 40. Manufacture and repair of sources of ionizing radiation 41. Manufacture of school and office equipment, except paper products, the manufacture of costume jewellery, brooms and brushes, made-up articles, umbrellas, souvenirs 42. Manufacture of other manufacturing articles 43. Operation of water supply and wastewater services, and water treatment and distribution 44. Waste management (except dangerous waste) 45. Preparatory and finishing work, specialized construction activities 46. Glazing, framing and mounting 47. Intermediation in trade and services (Import / Export) 48. Wholesale and retail trade (Shop, online sales) 49. Pawnbroking and retailing in second-hand goods 50. Maintenance of motor vehicles and accessories 51. Transport via pipelines and land transport (except rail and road motor transport) 52. Storage, packaging of goods, cargo handling and technical activities in transport 53. Forwarding and representation in customs procedure 54. Operation of postal and international postal services 55. Accommodation services (Hostel, Pension, Hotel) 56. Provision of software, information technology consulting, data processing, hosting and related activities and web portals (Programmers) 57. Activities of information and news agencies 58. Real estate services, facility management and maintenance (Real Estate) 59. Leasing and loaning of movables 60. Guidance and consulting activities, production of expert studies and opinions (Consultants) 61. Land consolidation design 62. Preparation and production of technical designs, graphic and drawing work 63. Design of electrical equipment 64. Research and development in the field of natural and technical sciences or social sciences 65. Testing, measurement, analysis and inspections 66. Advertising, marketing, media representation (Advertising for 3rd parties) 67. Design and arrangement activities and modelling 68. Photographic services 69. Translation and interpreting 70. Administrative services and services of an organizational and economic nature 71. Operation of a travel agency and guide services in the field of tourism 72. Extra-curricular education, organization of courses, training, including instructor services (Language teachers) 73. Operation of cultural, educational and entertainment facilities, organization of cultural productions, events, exhibitions, fairs, festivals, sales and similar events 74. Operation of physical education and sports facilities and organization of sports activities 75. Domestic washing, ironing, repair and maintenance of clothing, household linen and personal goods 76. Provision of technical services 77. Repair and maintenance of household goods, items of a cultural nature, precision equipment, optical equipment and measuring devices 78. Provision of personal and personal hygiene services 79. Provision of services for the family and households

80. Provision of services for legal entities and trust funds

81. Activities connected to the cryptocurrency and virtual assets

82. Manufacture, trade and services not elsewhere specified

Professional Tax & Trade License Services

Ready to start a trade license and begin saving on taxes? Our professional accountants at Pexpats can advise on everything from freelancing to generating side income as a full-time employee. Pexpats’ agents help self-employed entrepreneurs and professional businesses alike to register for and file taxes - accurately, hassle-free, and with maximum savings.

Just reach out and request assistance. We’ll investigate your case and suggest the best tax regime for you, including your eligibility for tax relief, discounts, and bonuses.