Czech Tax: Two Methods for Freelancers

Freelancers and trade license holders in the Czech Republic can choose between two tax methods:

Income minus expenses – Tax is calculated on your income after subtracting actual business expenses.

60/40 method – You automatically deduct 60% of your income as expenses, even if your real expenses are lower or zero.

The 60/40 method is ideal for freelancers with low expenses, as it reduces tax liability and requires no bookkeeping. Since you cannot combine both methods, most self-employed professionals prefer 60/40 for its simplicity.

What is the 60/ 40 Czech Tax Method?

What is the 60/40 tax method in the Czech Republic, and how does it apply to your personal income tax return? Pexpats explains!

How the 60/ 40 Czech tax rule works

The 60/40 tax method is the most common way Czech trade license holders file the personal income tax return. This is because it is advantageous for freelancers and businesses with very little business expenses. It is also extremely easy.

By tax law, it allows taxpayers to automatically deduct 60% of their gross annual income as a business expense. This is even if there were zero expenses for the entire year. It also requires no documentation, recordkeeping, or submitting invoices along with the tax return.

In this way, it is much simpler than the real expenses tax method, and in some ways similar to the flat tax method (Paušální Daň). The flat tax method doesn’t require you to submit the annual tax return, but isn’t always beneficial for taxpayers.

Who can use the 60/ 40 tax method?

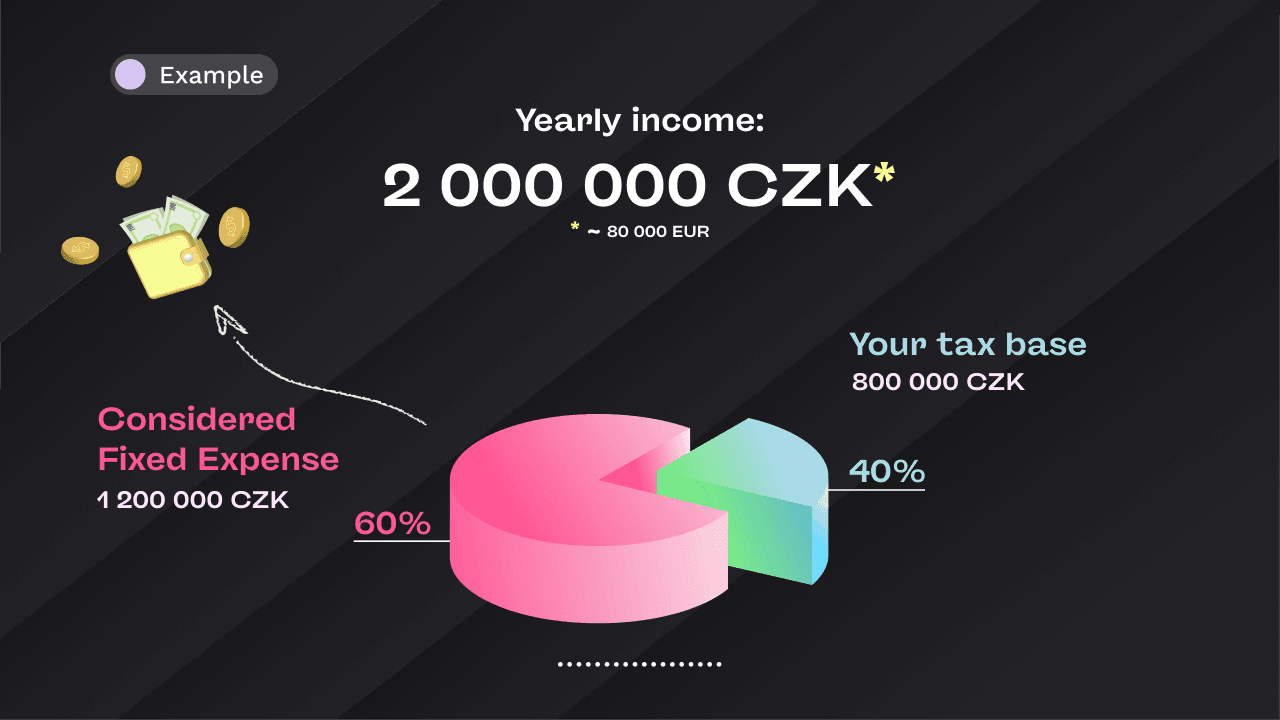

You can only use the 60/40 method on income up to a certain limit. In 2024, the income limit for deducting 60 percent of expenses is CZK 2 million. This is approximately 80,000 Euros.

If you earn over CZK 2 million, the 60/40 method is still applicable, but only for the income up to the two million koruna limit. Anyone qualifies for the 60/40 tax method

How it works for income over CZK 2 million

Say for example that you earn 100,000 over the CZK 2 million limit. In this case, you can still deduct 60% of expenses on your income up to the 2 million.

The remaining 100,000 will adjust your final taxable income. In this case, the calculation would be:

CZK 2 million x 60% (deductible) + CZK 100,000 = CZK 900,000 taxable income.

This taxable income will then have a tax rate of 23 percent. That is rather than 15 percent, as this amount falls into the higher tax bracket.

Can you deduct additional expenses?

If you use the 60/40 expense method in the Czech Republic, you cannot claim any extra deductions. The 60% is already deducted from your gross income without invoices or receipts.

You must choose:

Lump-sum deduction (60%), or

Real business expenses (laptop, office equipment, travel, car, etc.).

You cannot combine both methods. The better choice is the one that gives you the lower taxable income. Calculate both options and decide which works best for you.

Czech 60/40 Tax Method — Quick Overview

Item | Explanation |

|---|---|

Definition | A lump-sum expense method that lets freelancers deduct 60% of gross income as expenses |

Who can use it | Czech trade license holders (OSVČ) |

How expenses work | 60% is deducted automatically, even if real expenses are lower or zero |

Income limit | Applies up to 2,000,000 CZK |

Income above the limit | Every CZK above 2,000,000 CZK is taxed without the 60% deduction. |

Proof of business expenses | Not required |

Combining with real expenses | Not allowed |

How to calculate personal income taxes online

The Czech tax system can be confusing, but it doesn’t have to be. Try Pexpats’ completely free online tax calculators and tools for employees, freelancers, and expats in the Czech Republic. We developed these custom solutions together with certified tax advisors and accountants to simplify Czech taxes and support our services. Explore the best of our free tools today, or find professional tax assistance in our service packages for Czech taxpayers.

Czech Trade License Tax Calculation

Enter your yearly gross income, and our online Czech tax calculator will estimate your income tax, social security, health insurance, and net income under the 60/40 tax method.