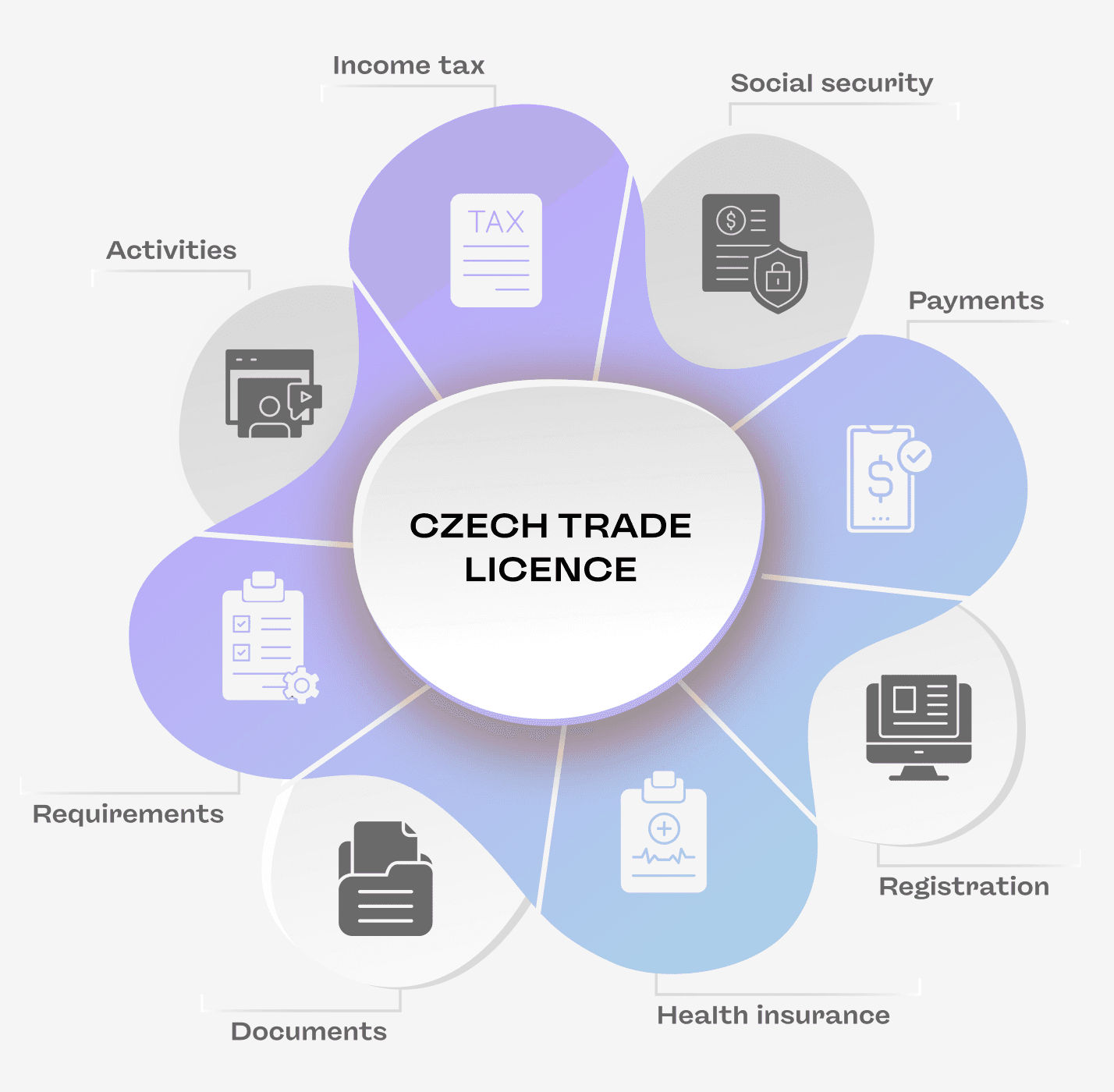

Trade license registration (zivnostensky list or zivno) is how freelancers legally work in the Czech Republic. It includes getting your trade license online on the platform, registering at the zivnostensky urad (Trade License Office), and completing other legal steps such as social insurance, health insurance, and income tax registration.

To begin, submit your application at the Trade License Office in the Czech Republic and take care of the follow-up steps to avoid unexpected penalties or missed tax filings.

You can register your trade license:

Online via the official Czech Trade Licensing portal or through agencies like Pexpats

In person at your local Zivnostensky urad (Trade License Office) — bring your passport, proof of address, and business activity description

Follow these clear steps to register your Czech trade license (zivnost) in 2026 and run your freelance business legally.

Step 1: How to Register a Trade License (Zivno) in the Czech Republic

Your first step is to register your zivnost and activate your ICO (Identifikacni cislo osoby – business ID number).

Once your Czech trade license is registered, you will receive the official confirmation certificate of your trade license registration in the Czech Republic.

The registration certificate will include information such as your full name, date of birth, business address, your business number (IČO), and a list of the business activities you're authorized to perform.

However, completing the following registrations is important to avoid debts and fines from the Czech tax office (financni urad) and other authorities.

Step 2: Register for Czech Social Tax (Socialni pojisteni)

After receiving your ICO, you must register for social insurance (socialni pojisteni). This will generate your unique social tax number, which you’ll need to make monthly contributions and file your income tax (dan z prijmu) report the next year.

Once officially registered, you’ll receive a confirmation with your social insurance number.

Step 3: Health Insurance Registration (Zdravotni pojisteni)

Health insurance is mandatory for most freelancers in the Czech Republic. After social tax registration, you must register for Czech public health insurance (zdravotni pojisteni).

Once approved, you’ll receive a Temporary Health Insurance Certificate, which works the same as the Health Insurance card and allows you to access all healthcare services and hospitals in the Czech Republic.

Important for employees with side income (Pexpats advice):

If you already have employment and register a trade license for side income, you must also register your health insurance and Social Tax as secondary income. Otherwise, both Authorities will classify registrations as primary and require you to pay the minimum monthly contributions.

Step 4: Order Your EHIC Card (For EU Citizens)

If you’re an EU citizen, you can now order your European Health Insurance Card (EHIC) after registering for health insurance. This card provides full coverage in the Czech Republic and emergency coverage in all EU countries.

Note: If you have family members living in the Czech Republic, you must also register them under your health Insurance.

Step 5: Monthly Payments – Social and Health Insurance Contributions

If your zivnost is your main source of income, you’ll need to pay monthly deposits for social tax and health insurance. These payments begin in your first year and must be made on time to avoid fines or delays in your tax return.

If your trade license is your secondary income (e.g. you also have full-time employment in Czech Republic), you won’t pay deposits in your first year — but you’ll still need to pay your contributions after declaring your income tax.

If you’re a student under 26, retired, or on maternity leave, your trade license should also be registered as secondary income (vedlejší činnost) for both social security (ČSSZ) and public health insurance (VZP or another provider).

You can learn more about secondary income taxation here.

Step 6: Income Tax Registration and Getting Your DIC (Tax Identification Number)

Next, register for income tax (dan z prijmu) at your local financni urad (tax office). You’ll be assigned a DIC (danove identifikacni cislo), which is your Tax Identification Number (TIN) in the Czech Republic.

As of 1.1.2024, DIC registration is not mandatory, so the tax office may say it’s not required. However, for foreigners, it’s important to have a DIC for proper tax filing and communication with the tax office.

Ask to register voluntarily and explain your business needs. Once confirmed, you’ll receive your DIC registration certificate with your Tax number.

Step 7: VAT Registration (DPH) for EU Invoices

You only need to register for Light VAT (DPH) if you invoice companies registered in another EU country. If so, register with the tax office (financni urad) and begin submitting monthly VAT reports.

Although you’ll invoice with 0% VAT, and won’t pay VAT to the Czech authorities but reporting is still mandatory.

Once registered, you’ll receive a VAT number.

Note: Missing VAT registration or monthly reports may result in fines up to CZK 500,000.

Frequently Asked Questions About Trade Licenses in the Czech Republic

Q: Can I register a Czech trade license (zivnost) online?

Yes, freelancers can register their zivno either online or by visiting their local zivnostensky urad (Trade License Office).

Q: What documents are required for zivno registration?

To register your trade license (zivnost) in the Czech Republic, you need the following documents:

Valid passport

Business address consent form (signed by the property owner)

Czech residency permit (only for non-EU citizens)

Criminal clearance report from your country of origin

Completed zivno registration application form

These documents are submitted at your local Zivnostensky urad (Trade License Office) or can be filed online through official platforms or agencies like Pexpats.

Q: Do I need to renew my Czech trade license?

If you are a non-EU citizen, your Czech trade license (zivno) will expire when your visa or residency permit expires. This means you’ll need to renew your trade license every time you extend your visa or residency. If you don’t, your license will expire, and you’ll have to go through the full trade license registration process again as if you were applying for a new one.

Q: What’s the penalty for not registering VAT (DPH)?

The fine for postponing registration or reporting VAT can be up to CZK 500,000.

Q: Where can I find a list of trades covered by a Czech trade license?

You can view the official Czech trade license list on the Ministry of Industry and Trade website, or consult your local zivnostensky urad.

Q: Where do I go to register my trade license in person?

Visit your local zivnostensky urad (Trade License Office). These offices are located in every major city and district — such as Prague 1, Prague 3, or Brno — and you can find them listed on your city’s municipal website.

Czech Trade License Terms (English–Czech Glossary)

Understanding basic Czech terms can help you fill out forms, communicate with authorities, and follow the rules related to your trade license. Here’s a quick list of important words with their Czech translations:

Czech Trade License — Terms Used in Registration

English Term | Czech Term | Meaning |

|---|---|---|

Trade License | Živnost / Živnostenské oprávnění | Legal permission to operate as a self-employed person |

Trade License Register | Živnostenský rejstřík | Official register where trade licenses are listed |

Self-employed person | OSVČ | Czech term for a self-employed person or freelancer. |

Business Activity | Předmět podnikání | Type of work you register on the trade license |

Identification Number | IČO | Business identification number in the Czech Republic. |

Tax Identification Number | DIČ | Tax identification number used for income tax and VAT in the Czech Republic. |

Health Insurance | Zdravotní pojištění | Mandatory public health insurance |

Social Security | Sociální pojištění | Mandatory social insurance contributions |

VAT | DPH | Value Added Tax |

Data Box | Official digital mailbox for communication with Czech authorities. |

This blog is regularly updated with 2026 rules and practical steps for freelancers in the Czech Republic, covering everything from trade license registration to changes in zivnost and tax office procedures.